Hello there, Mark. I'm here to share some information about how you can handle duplicate billable expenses in QuickBooks Online.

Before making any changes to your books, I highly recommend consulting with your accountant to get accurate advice on handling your transactions accurately.

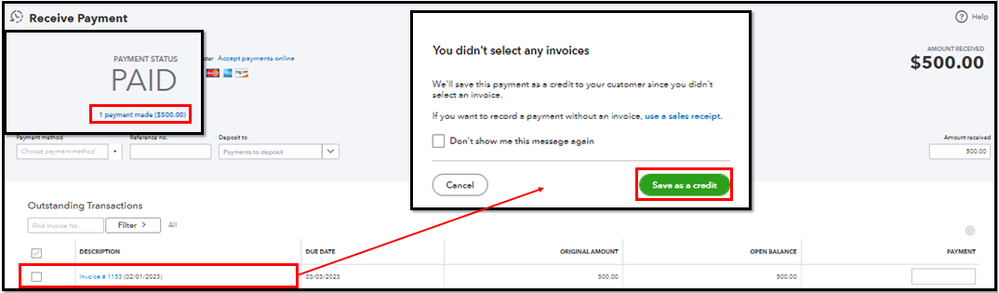

To sort this out, we can unlink the payment so it will leave as credit that you can use in future invoices or return as a refund. Simply open the mistakenly created invoice and click the 1 payment made link. Then, untick the checkmark beside the invoice to save the payment as a credit.

Once done, proceed to delete the invoice associated with billable expense and the receipts uploaded and made billable in error.

Moreover, here are some articles for reference when handling your customer transactions and reconciling your accounts:

If you have other questions while handling your billable expenses, please feel free to comment below. I'm here to assist you further. Stay safe!