Glad to see you in the Community, TAMARAKATRINA.

Thanks for being detailed about your concern. I have the steps to help record the remaining credit to your vendor’s credit card.

To apply the transaction to the credit card on file, you can either make a deposit or Enter Credit Card Charges. If you prefer to use the previous troubleshooting, check out the Record and make Bank Deposits in QuickBooks Desktop article for detailed instructions. However, if you opt to track it using the Enter Credit Card Charges method, follow the steps I laid out below.

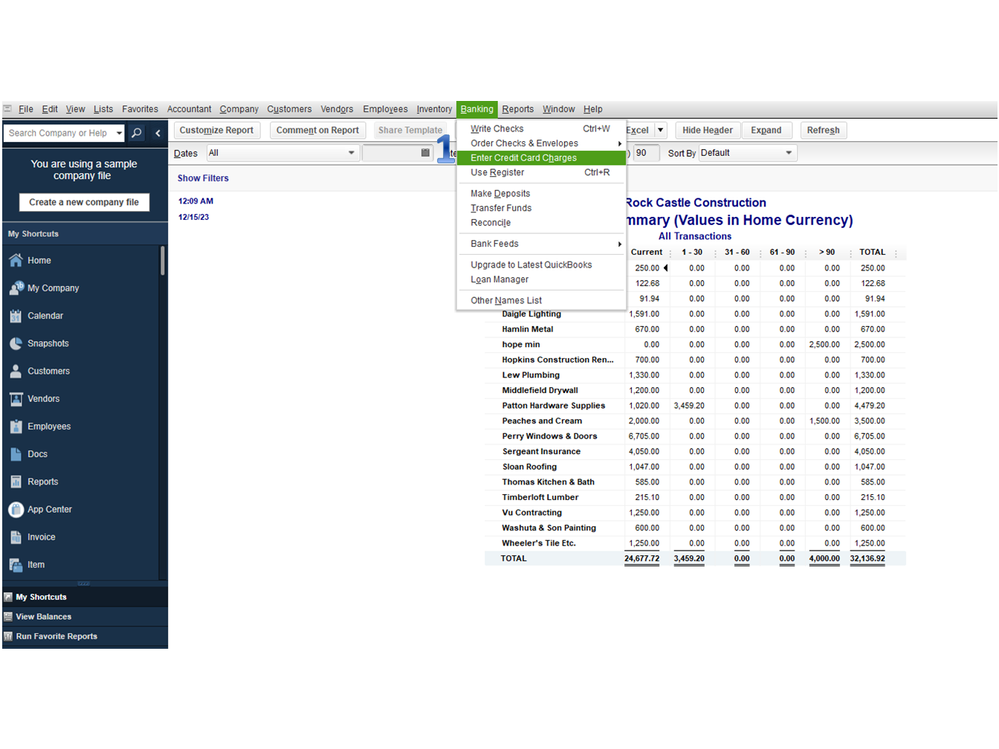

- Go to the Banking menu and pick Enter Credit Card Charges.

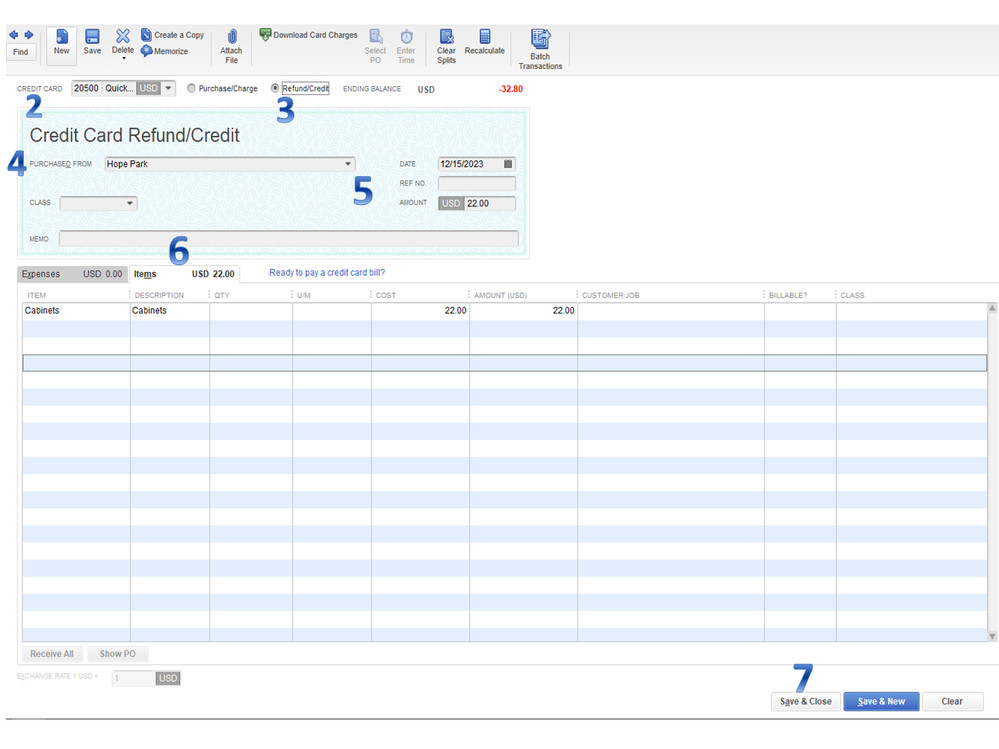

- From the Credit Card drop-down, select the correct credit card account.

- Mark the radio-button for Refund/Credit.

- Click the Purchased from drop-down to choose the vendor’s name.

- Fill in the field boxes.

- If you returned Items, select the Item tab and enter the product and amounts from the refund. If the refund does not have Items, select the Expenses tab, select the appropriate accounts, and enter the amount.

- Press Save & Close.

You can bookmark the Record a vendor refund in QuickBooks Desktop guide for additional resources. It contains troubleshooting steps on how to track a supplier’s refund or credit. The article is scenario-based so choose which one that fits the situation.

With this information, the remainder of the credit is tracked on the credit card in no time.

Stay in touch if you need additional information about vendor refund/credit. I’ll pop right back in to answer them for you. Have a great rest of the day.