I can walk you through on how to record the customer's payment with a credit card fee, PAAAHJ.

You need to record the payment in full using the Receive payment feature. It hits the balance from accounts receivables and you move it to the Undeposited funds account.

Let me show you how:

- Go to the + New button on the left menu.

- Choose the Receive Payment.

- Select the customer, then mark the invoice.

- Choose Undeposited funds from the Deposit to field.

- Click Save and Close.

After that, make a bank deposit so you can add the fee. Then, post it to your actual bank account. Here's how:

- Click + New.

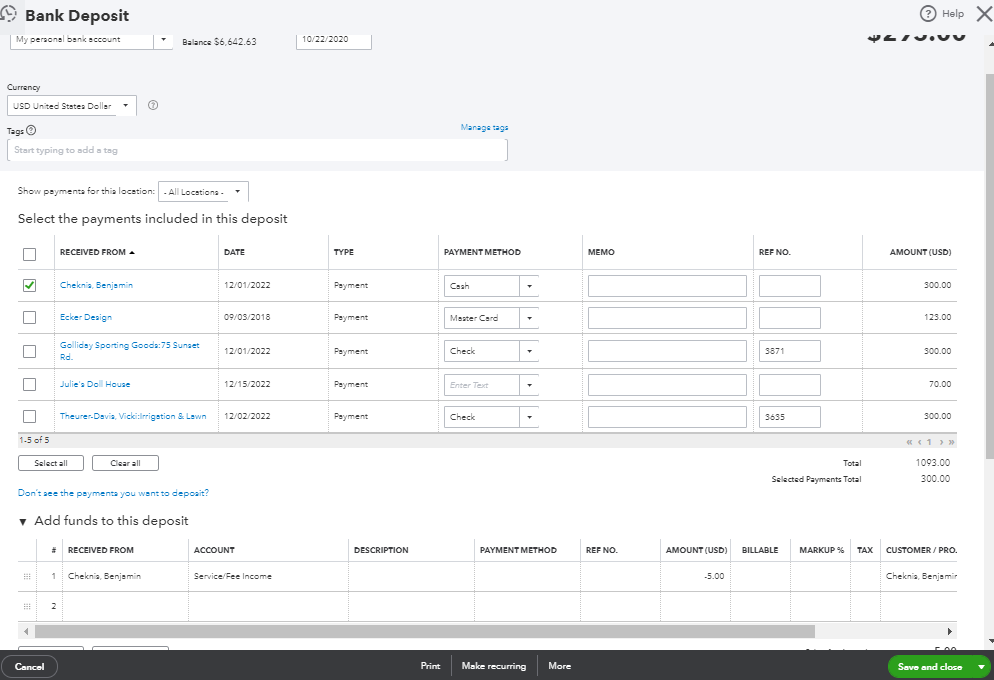

- Select Bank Deposit.

- From the Account drop-down▼menu, choose the account you want to deposit the money into.

- Mark the payment you've entered above from the Select the payments included in this deposit section.

- Go to Add funds to this deposit and enter the fee.

- Select Save and close.

I'm adding these articles for your future reference:

Feel free to leave a comment below if you need anything else about recording customer payment. I'm always right here to help you.