Let me provide information on how Solopreneur works, NSCHROEDER.

When using QuickBooks Solopreneur (QBSP), you can manually enter the previous invoices one at a time and record the payments from there. To do so, follow the steps provided below:

- Go to Get paid and select Invoices.

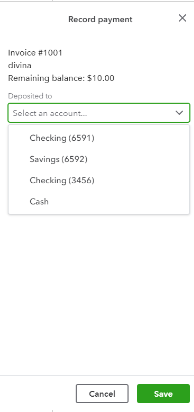

- Find the unpaid invoice and select Record payment.

- From the Deposit to dropdown, select the account you put the payment into.

- In the Amount field, enter the amount your customer paid. This can be the full or partial payment.

- In the Payment date field, select the date your customer paid you.

- Select Save.

Please know that you'll have to connect your bank if you want to show other options under the Deposit to field other than Cash. You can follow the steps on how to link your bank account:

- Go to the Transactions menu, then click the New transaction drop-down.

- Select Link account.

- Enter your bank name or URL.

- Click Continue.

- Follow the prompt to successfully connect with your bank.

Once connected, you'll have an option to choose a different bank account on the list. I've added a screenshot for your visual reference:

Furthermore, QuickBooks Solopreneur is designed for Schedule C filers and is commonly used for sole proprietors or single-member LLCS. To know more about this, please read this article for reference: Introduction to QuickBooks Solopreneur.

Let me know if you need further assistance with invoices. I'm always here to help you. Have a nice day!