It's great to have you in the QuickBooks Community, @elegantlimo.

You can record non-invoiced income in QuickBooks Online (QBO) using either a Sales Receipt or a Bank Deposit, depending on the nature of the income and your specific needs. I'm here to guide you through both processes.

A Sales Receipt is used to document transactions for goods or services that are paid immediately. It will also help you keep track of these transactions under the customer's profile. You can follow these steps to create one:

- Click on the +New button in your QBO account.

- Select Sales receipt.

- Choose a customer from the Customer drop-down list. Then, enter the Sales Receipt Date.

- From the Product/Service column, choose the product or service item you've provided to your customer. Ensure that the product or service is posted to the intended income account.

- In the Deposit To drop-down list, choose the bank account where the funds will be deposited.

- Review and add other details on the sales receipt screen to information that applies.

- Hit Save or Save and close.

Alternatively, if the income is directly deposited into your bank account and doesn't need to be tracked in the customer's transactions list, you can create a Bank Deposit. Here are the steps:

- Go to +New. Then, choose Bank deposit.

- Choose the bank account from the Account drop-down list.

- Choose the deposit Date.

- In Select the payments included in this deposit section, place a checkmark for the invoice payments if you need to combine them with your non-invoiced income.

- Scroll down to the Add funds to this deposit section.

- Choose the customer from the Received from column.

- Select the intended income account from the Account column.

- Enter the Amount and ensure to review other details in the bank deposit.

- Hit Save and close.

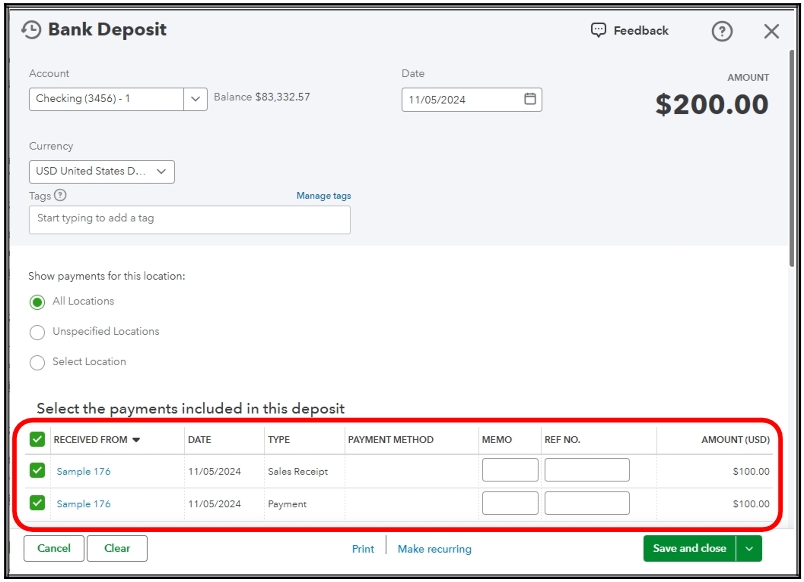

If a sales receipt transaction better fits your needs and you need to combine it with an invoice payment, ensure posting both the sales receipt and the invoice payment to the Undeposited Funds (or Payments to Deposit) account. Then, create a bank deposit as described above. In this bank deposit, simply place a checkmark for the sales receipt and invoice payment transactions to combine them. Please refer to the screenshot below.

I'm also including this article for guidance on matching QuickBooks Online transactions to your downloaded transactions from your bank feed: Match online bank transactions in QuickBooks Online.

We're here in the Community if you have further questions about recording income in QBO. We'll do our best to assist. Take care!