Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

You're in the right place, @DLA_001.

There will be times when you know certain invoices aren't going to be paid. This is called bad debt, and you can write off your invoices to a bad debt account to record this. Due to the extensive nature of the steps required to set this up, I'm going to provide the article below. This will guide you step-by-step on how to set up a bad debt account in your chart of accounts, how to create a bad debt item, creating a credit memo for the bad debt, and applying that credit memo to the invoice.

Write off bad debt in QuickBooks Online

Let me know if you run into any other questions by using the Reply button below. I'm determined to be your number one resource for QuickBooks Online.

Unpaid invoices have no impact on cash reporting, so whether you write them off to bad debt or try to get paid is immaterial to cash basis reporting.

How you report your company for income taxes, may or may not have anything to do with sales taxes. Almost all states required that you report and pay sales taxes on the accrual basis. You need to check with your state comptroller for sales tax to find out.

Can we have the solution for QB desktop? We dont have the online version and I can't find out where to put in the "Bad Debt" category

Can you please let us know how to do this but not the online version,our company has the desktop series.

Hi there, @DeepBlueMarine.

I appreciate you for joining the thread. I can help you with setting up an account for tracking bad debt in QuickBooks Desktop (QBDT).

Here's how:

To close out your old invoices, I recommend following the instructions from this article under Step 2: Close out the unpaid invoices: Write off bad debt in QuickBooks Desktop.

For more tips about managing A/R transactions in QuickBooks Desktop, you can open this article: Get started with customer transaction workflows in QuickBooks Desktop.

If you have any other questions about your invoices or when setting up your chart of accounts, please let me know by adding a comment below. I'm always here to help. Have a good one!

Thank you-- But how do I get it to not reflect that the income brought into the business. It's coming up as income in- when truthfully it's a "bad debt" that never got paid.

Example "Joes Marine Shop" invoice from 2008 is still open because the money was never recevied. Whats the best process to clear that up but no erase it completely?

Thanks for coming to the Community, @DeepBlueMarine. I'm here to share some insights about writing off unpaid invoices.

What accounting method are you using? With accrual-basis accounting, revenue is recognized when it’s earned (which may be different from the period in which the money is received). With cash-basis accounting, revenue is recognized when payment of invoices is received. If you haven't closed the unpaid invoice yet using the bad debt expense, the invoice won't show in the Profit and Loss report on a cash basis.

Follow these steps to write off the unpaid invoice:

Once done, the amount will be deducted in the Profit and Loss report as bad debt. These instructions are available from our guide on writing off bad debt in QuickBooks Desktop.

You can read through this article for more insights when running a report in QuickBooks Desktop: Understand reports.

I'm only a few clicks away should you need further assistance. I'm always here to help. Have a wonderful day!

I have invoices dating back to 2005 as unpaid, as the President has me send statements each month to the client. However, he has now decided to write this and 3 other client debts off that are never going to be received. We are on a CASH BASIS and I understand that you can't "write off" debt that was never accounted for as income. Therefore, I was going to create credit memos and clear them, but that requires that same amount be entered somewhere else in QBs. As I recall, we needed to "delete" these invoices in the past, keeping a copy of the original so we know what the transaction looked like, in case we do ever see money from them. So, I'm not sure why in a CASH BASIS I'd put a "Bad Debt" line on the P&L? Need an answer ASAP! Help and thank you in advance!

Hello there, @Jbear1212.

When you're running your Profit & Loss Statement on a cash basis, your income will increase by the amount of the bad debt written off. But, you'll also have an expense (Bad Debt Expense) in the same amount, so they cancel each other out and net income remains unpaid.

For the step-by-step guide on how to write off bad debt, you can refer to this article: Bad debt in QuickBooks Desktop.

After that, I'd recommend pulling up the Accounts Receivable Aging Detail report. This way, you're able to keep track of your customer's open balances. Just go to the Reports menu, then select Customers & Receivables.

To learn more on how QuickBooks generates reports, you can check out this article: Understand reports. It includes the complete list of available reports in QuickBooks Desktop (QBDT).

Please let me know if you have other concerns about managing invoices and bad debts in QBDT. I'm just around to help. Take care always.

I followed these instructions, but when I created the Receive Payment, there is no credit section to select the Credit Memo. Has this changed since 2020? Do you have updated instructions?

I’m here to clear things up for you, @ashlee1. I’ll help you apply a credit memo to your customer’s invoice in QuickBooks Online.

I've replicated this situation on my QuickBooks Online (QBO) test account. I've confirmed that it works just fine. Going directly to an invoice, then pressing the Receive payment button, any open credit memos will be listed under the Credit section.

If this isn't the case, I suggest you check your settings and see if the system is automatically applying these credits. Let’s make sure we turned off the auto apply credits so that the credit memos will be shown.

Here's how:

Once done, you can then manually apply the credit memo to an invoice:

In case you need to create and apply a delayed credit to an invoice, you can click here. It can help you handle your credits in QuickBooks.

For reference, you can check out this article to learn about bank deposits in QuickBooks Online. This can guide you in matching your recorded transactions here to those in your bank.

Do you need further assistance with applying credits? Place a comment below, and I'll get back to you. It'll be my pleasure to help you. Wishing you well!

I have the desktop version so how would I write off an old invoice?

I’m here to help write off your old invoice, Debbie.

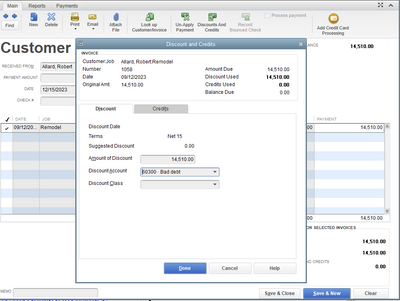

You can use the credit memo feature with a bad debt expense item to write off an invoice in QuickBooks Desktop. This helps ensure your sales tax liability account is intact.

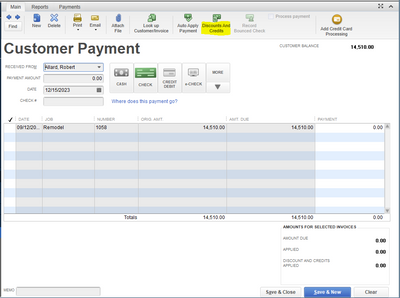

Here’s how:

Another way to close out the unpaid invoices is through the Receive Payments option. But before that, you need to add an expense account to track the bad debt. This way, you can ensure the accounts receivable and net income stays up to date.

Also, you can contact your accountant to guide you further and have some tips in managing old transactions.

You can generate reports anytime to see useful information about your business. It helps you understand the concept of source and targets when customizing them.

I’ll be here to help if you have any other questions or concerns besides writing off an old invoice. You can press the Reply button below to add your comments. Have a good one and always take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here