Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowget IRS pub 946 it is a free download

then you make a journal entry

debit depreciation expense, and credit accumulated depreciation asset

get IRS pub 946 it is a free download

then you make a journal entry

debit depreciation expense, and credit accumulated depreciation asset

Hello Rustler. I have an issue here, back in 2017 I purchased some computers and furniture, none of that has been depreciated. Can I do the depreciation as of 12/31/2019? If so, straight line depreciation is OK?

After properly recording depreciation, it does not show as a line item in my P&L? Any suggestions?

Thanks for joining on this thread, @traderspot.

I appreciate you for sharing to us the result of the steps you’ve performed to record the depreciation. I can provide clarification on why the account didn’t show as a line item on the Profit and Loss Report.

This can happen when the date and category type used is incorrect. The date affects how the data are reflected in the report. I recognized that you’ve properly set up the depreciation.

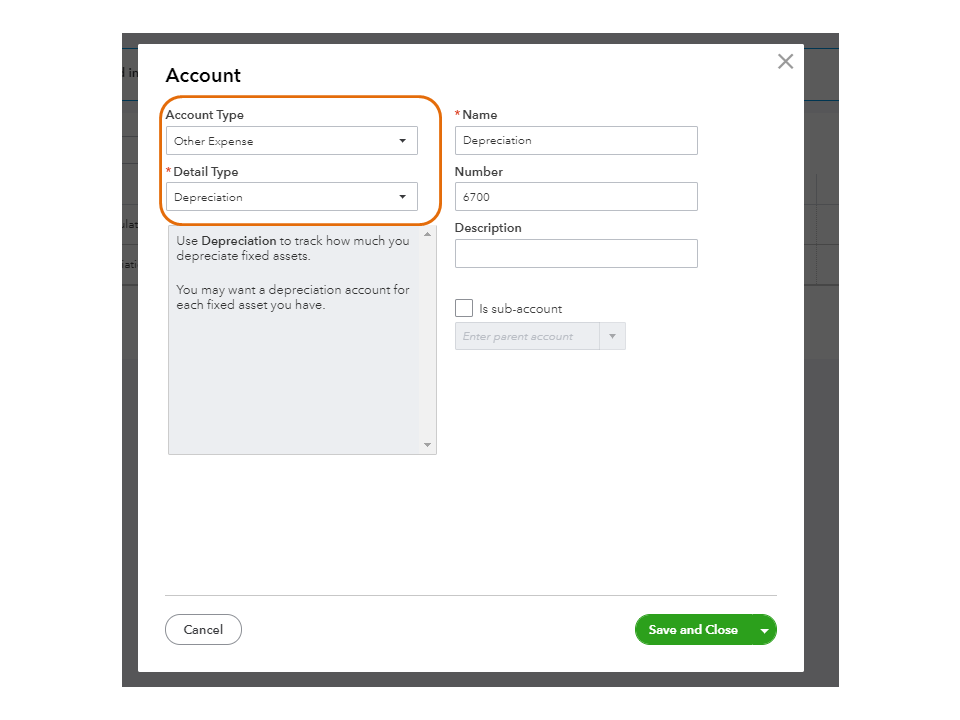

However, let’s review the account and make sure the Depreciation is selected as the Detail Type. Here's how:

Once done, open the Profit and Loss Report again and set the correct date in the Report period drop-down. After following these steps, you’ll be able to see depreciation in the Other Expenses section.

Let me share the Depreciate assets in QuickBooks Online article. It outlines the instructions on how to enter the account in your company.

Keep in touch if you have any other concerns or questions. I’ll get back to answer them for you. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here