A warm welcome to the Community, @Connie47. I'm here to ensure that you'll be able to add a class and apply taxes on your Journal Entry in QuickBooks Online.

The Canadian Sandbox works differently from QuickBooks. You’ll need to enable the Class Tracking feature in your QuickBooks account so you’ll be able to see the class column on your JE. Please take note that this is only available for Advanced and Plus subscriptions.

Here’s how:

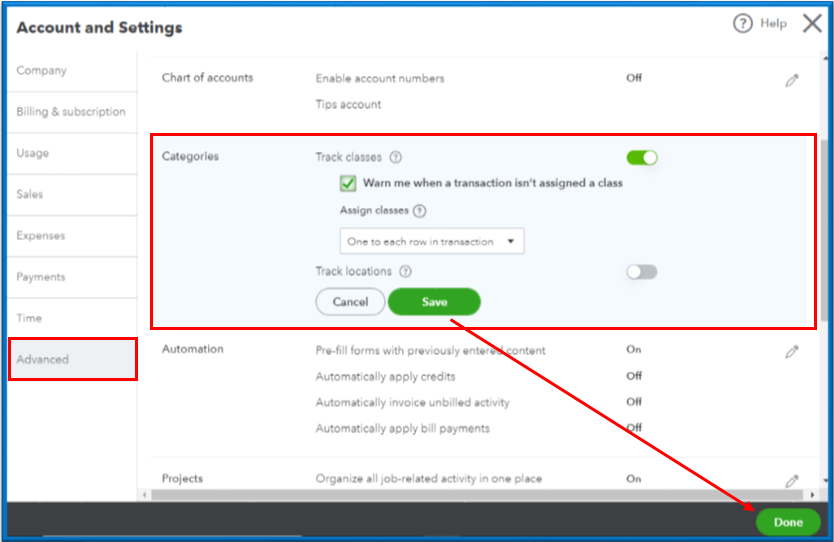

- Go to the Gear icon and click Account and Settings.

- Select Advanced.

- On the Categories, tick the Track classes checkbox.

- You have an option to check Warn me when a transaction isn't assigned a class, so when you look at reports, you know everything got classified.

- Under Assign classes, choose between One to entire transaction or One to each row in transaction.*

- Tap Save, then Done.

You might also want to utilize the location tracking feature in QBO. This helps you categorize your transactions from different locations, offices, regions, outlets, or departments of the same company.

After that, you can set up your class list to represent different aspects of your business. You can also turn on class tracking for your payroll transactions. See this article for the process: Turn on class tracking for Online Payroll.

On the other hand, you’ll need to set up your taxes first for the calculations. The tax amounts are based on the state where you have nexus and are registered to collect sales tax, the physical address of your business and on forms, and the product mapping you've assigned to the item you're selling. However, these won’t appear on the JE. You can check out this article for further guidance: Set up and use automated sales tax.

Once you're all set, you can now pull reports that contain classes and manage your taxes. I recommend checking out these resources attached to guide you through this procedure:

I've got your back if you have any other questions about classes and taxes. It’ll be my pleasure to answer them for you.