There are two options to tag a transaction as non-income, ali11.

You can either exclude it or categorize it as a personal transaction. Both options will automatically remove the transaction from your income and estimated tax calculation.

Just look for the refund in the Transactions menu and click the Personal button.

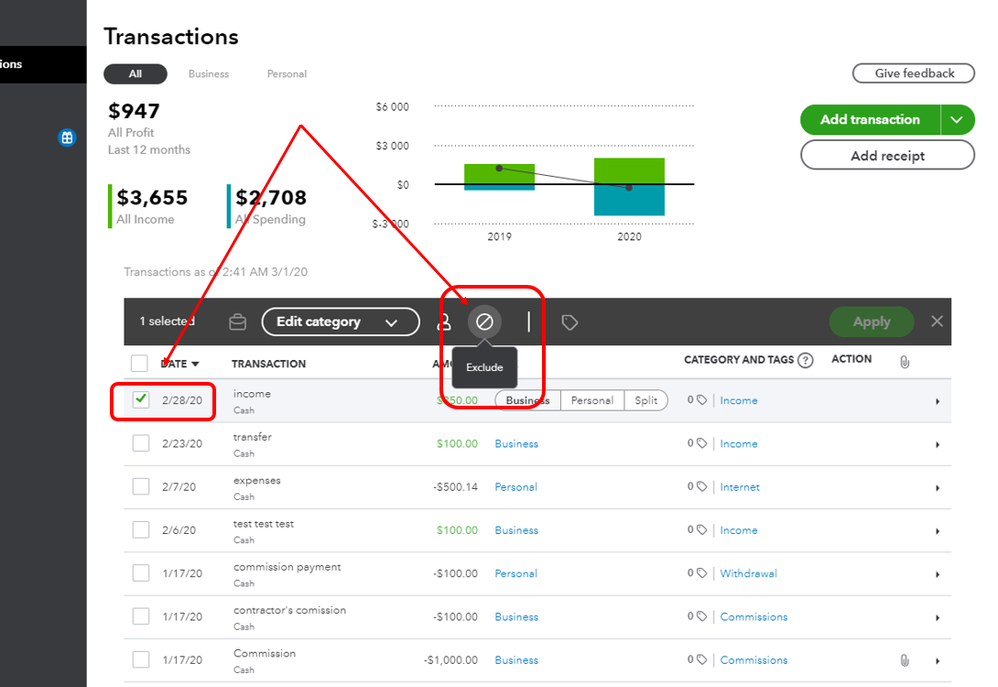

You can also follow these steps to exclude a transaction:

- Go back to the Transactions menu.

- Look for the refund and check the box before it.

- Click the Exclude icon.

To review your income amount, just go to the Reports menu and look for Profit and Loss. Then, select the correct year and click View.

Feel free to reply or reach out to us again if you have other questions in mind. It'll be a pleasure to help you again.