Welcome to the QuickBooks Community, @dcsc1.

I'd be glad to share some information on how to change the account for payroll checks and fix your account balance in QuickBooks Online (QBO).

We can start by updating the bank account in your accounting preferences under the payroll settings. Let me show you how:

- Go to Settings , then select Payroll settings.

- In the Accounting section at the bottom of the page, select Edit ✎.

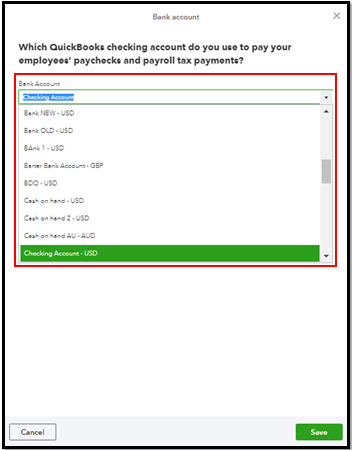

- Tap Edit ✎ in the Paycheck and payroll tax payments.

- Choose the correct account under the Bank account ▼ dropdown.

- Click Continue, then Done and Done.

For more details about this process: Change your accounting preferences in QuickBooks Online Payroll.

After updating to the correct posting account, you'll have to manually delete and recreate each paycheck transaction to fix the incorrect balance of your cash account. Another option is to create a journal entry to transfer the balance to the correct account. I'd also recommend getting help from your accountant to ensure that your books are accurate and to avoid messing up the data.

In addition, check out this article for future reference about running payroll reports in QBO: Run payroll reports. This will give you a closer look at your employee's total wages, deductions, and tax information for a certain period.

We're always around if you have any follow-up questions about updating payroll accounts. Just leave a comment below, and we'll get back to you. Have a great day!