Hello, lifangcai. You can send an invoice reminder to your customer to collect overdue payments or send out statements since the feature to generate a debit note directly is unavailable.

In QuickBooks Online, you can manually send reminders to customers to collect overdue payments. Please follow these steps to proceed:

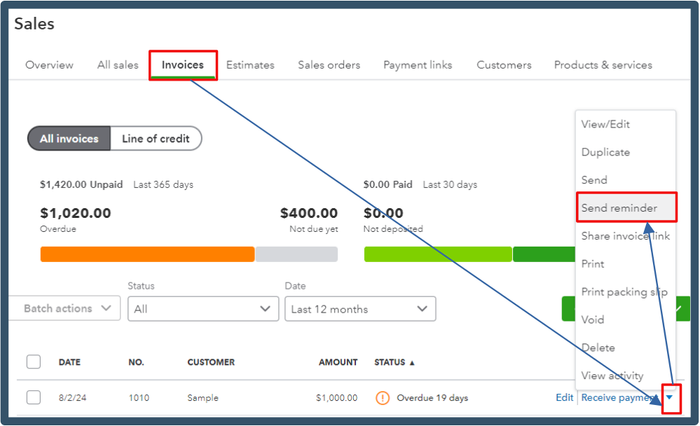

- Go to Sales, then Invoices.

- Find the invoice for which you want to send a reminder.

- From the Receive payment dropdown, hit Send reminder.

- Customize your messages by adding the debit note information.

- Once done, press Send.

Additionally, you can set up automated invoice reminders that will be sent out to your customers to remind them of their upcoming due dates. This feature can help you maintain positive relationships with them while ensuring you receive timely payments.

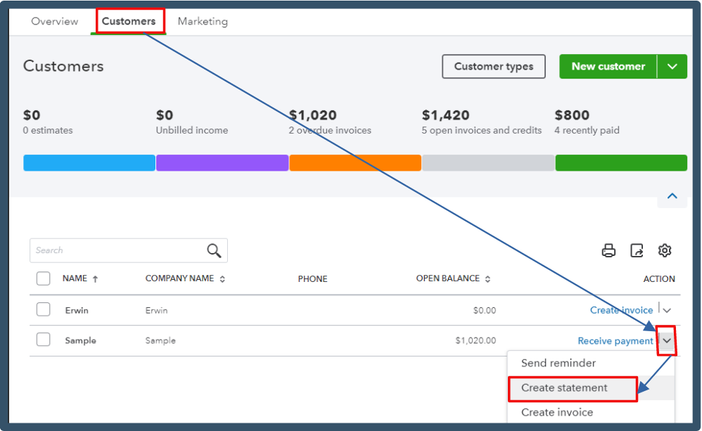

Meanwhile, if you want to send a customer statement to give comprehensive details of their associated invoices, payments, and outstanding balances, here's how you can do it.

- Head to the Customer menu. Choose the person you want to make a statement for.

- Click the New Transaction dropdown. Pick Statement.

- Double-check the email address. Hit Save and close.

You can download it by selecting Print or Preview, then selecting Download.

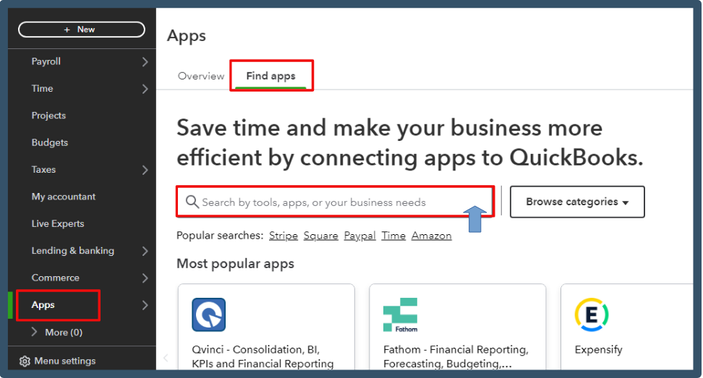

If you wish to create a debit note for proper documentation, you can explore our third-party app that offers this feature as an alternative solution.

You can directly visit our QuickBooks App Store or go through the Apps menu in your product.

Let me assist you with how to do it:

- Click Apps from the left panel, then go to the Find Apps tab.

- From the search bar, type in the keyword to look for an app.

- Once done, you can choose an app from the lists that suits your business needs.

Moreover, I'm adding these informative articles for a guide in handling your invoices and sales taxes:

Whenever you require further clarifications regarding your invoices and collective accounts receivable, I'm always here to back you up. You can enter any queries by clicking the Reply button below.