Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Welcome to the Community, @teld9d.

I'm here to help record your business expense paid with your own and your partner's funds in QuickBooks.

You can create a journal entry to debit the amount to an expense account and credit to an Owner's equity or Partner Equity. Then record the reimbursement using a check or expense transaction.

Please refer to this article for the detailed steps: How to pay for business expenses with personal funds.

You can also check this link for more information: About mixing business and personal funds.

I'd like to include this helpful article as well just in case you may need to transfer funds between accounts in the future: How to record a funds transfer between two accounts.

That should do it. If you have additional questions about the process, do let me know. I'm here to help however I can.

Welcome to the Community, @teld9d.

I'm here to help record your business expense paid with your own and your partner's funds in QuickBooks.

You can create a journal entry to debit the amount to an expense account and credit to an Owner's equity or Partner Equity. Then record the reimbursement using a check or expense transaction.

Please refer to this article for the detailed steps: How to pay for business expenses with personal funds.

You can also check this link for more information: About mixing business and personal funds.

I'd like to include this helpful article as well just in case you may need to transfer funds between accounts in the future: How to record a funds transfer between two accounts.

That should do it. If you have additional questions about the process, do let me know. I'm here to help however I can.

Under the expense say I bought a tool for 100.00 can I just add an entry under the expense that says partners equity and -100.00?

The amount should be positive, @land7784.

I appreciate you for sharing your concern on the Community page.

When creating a Journal Entry (JE) in QuickBooks, you’ll have to enter a positive amount to balance the debits and credits. So instead of -100, make it a positive 100.

The first line of JE increases their expense account's balance while the second line increases your Partner's Equity account's balance.

Here are the screenshots for your visual reference:

I also have a video tutorial here to learn how to pay expenses with owner funds. I’m sure you’ll find it helpful.

In case of assistance or additional guidance, just leave us a message. I’ll get back to you as soon as I can. Have a good one.

The video shows to enter the expense and under it enter the partner equity as a -100. which brings the expense to zero. You showed me to enter a journal entry is this two ways of doing the same thing?

Hello there, @land7784.

There are corresponding accounts when creating a Journal Entry. If there are two accounts added, another same account to follow. This will offset the parent account to make the journal entry balance out. Both the debits and credits have to equal.

As the video shows, you can create an expense transaction to make the expense to zero. Since using the Journal Entry won't add a negative amount.

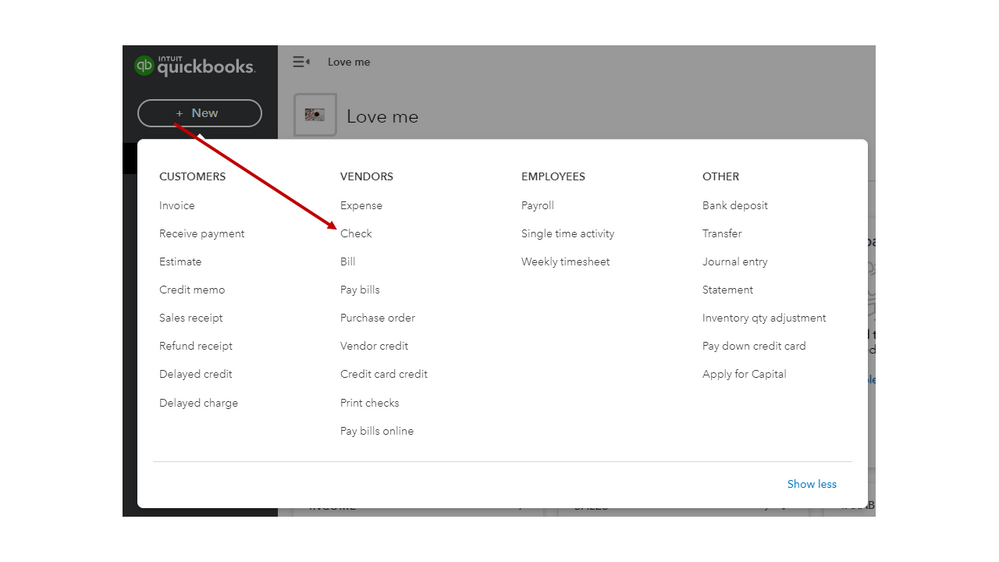

Here's how to do it:

You can use this article on how to manage your expense like modifying and deleting expenses: Enter, edit, or delete expenses in QuickBooks Online.

This article will serve as your guide on when to enter bills and when to record your expenses: What are the differences between bills, checks, and expenses?.

Please feel free to leave a query to this thread if there's anything else. I'll be glad to help you. Take care!

Sorry MaryAnn I am a little slow, so basically your saying the journal entry is the best way, if I follow the steps and add the expense and partners equity amount, then if I am understanding correctly I do not have to add a separate expense in the expense section.

Joining the thread to share some more information about this, @land7784,

There are two ways to record a personal expense.

If you want to follow the one on the video, then yes, it's okay to use an expense entry and assign a negative amount for Owner's Equity. This process works similarly as the second option using a journal entry, except that you no longer need to assign a negative sign for OE. This is because, crediting capital on a JE will increase it's balance.

Regardless, both options has the same posting on financial reports. See the following screenshots for your guide, or see which method you prefer:

After the expense money is returned to the Owner's Equity account for the partner, you can now proceed to refunding him/her. Use Steps 2 of this article to complete the process: Pay for business expenses with personal funds.

If you have any more questions, feel free to tap me anytime. I'll be right here to guide and help you. Have a good one!

Hi, then how exactly do you write a check for reimbursement using a check or expense transaction? Can you show the different ways in a picture? I would write it to the LLC member and under what act should I use? Thanks

I'd be happy to walk you through the process of reimbursing your member via check and expense, Waterboy1.

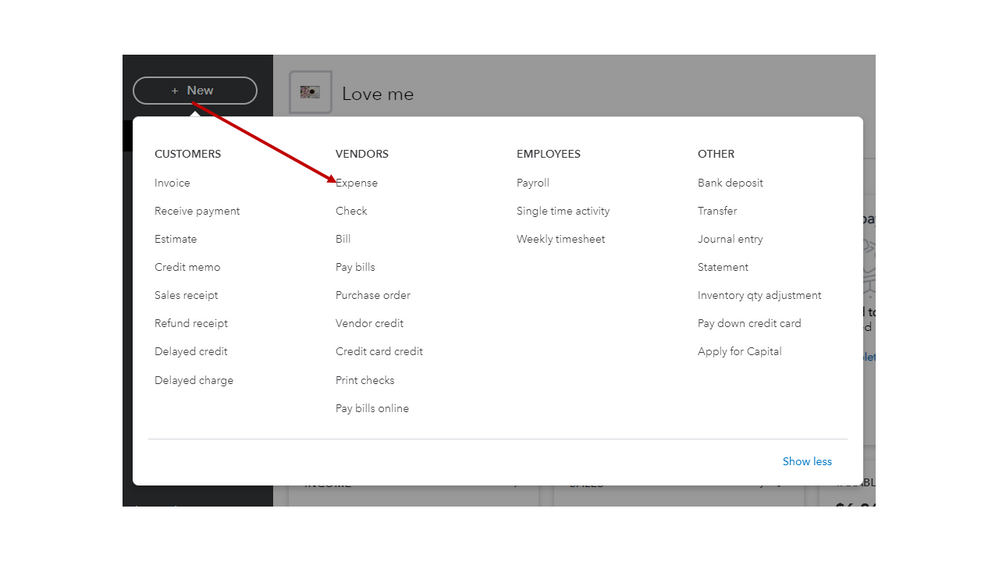

The accuracy of our customers' records is our top priority in QuickBooks Online (QBO). Because creating a reimbursement requires us to add a specific account, I recommend consulting an accountant to determine which one to use for the transaction. When you have all of the necessary information, proceed to the following steps to write a check:

This is how it should like after following the steps:

To record an expense:

To help decide when to enter an expense, bill, or check in QBO, click here for the full details. Save the expenses and vendor guide in your browser for future reference. It covers topics such as processing vendor credits, managing money-out payments, and other supplier-related tasks.

If you need further assistance recording a reimbursement or have other QuickBooks questions, leave a comment below and tag my name. I'll be right back in to help you out. Have a wonderful weekend.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here