Thank you for dropping by the Community today, nicholas-legacyr.

I recognize the importance of recording the gifts for your clients. This will mirror what happened to your actual business transactions.

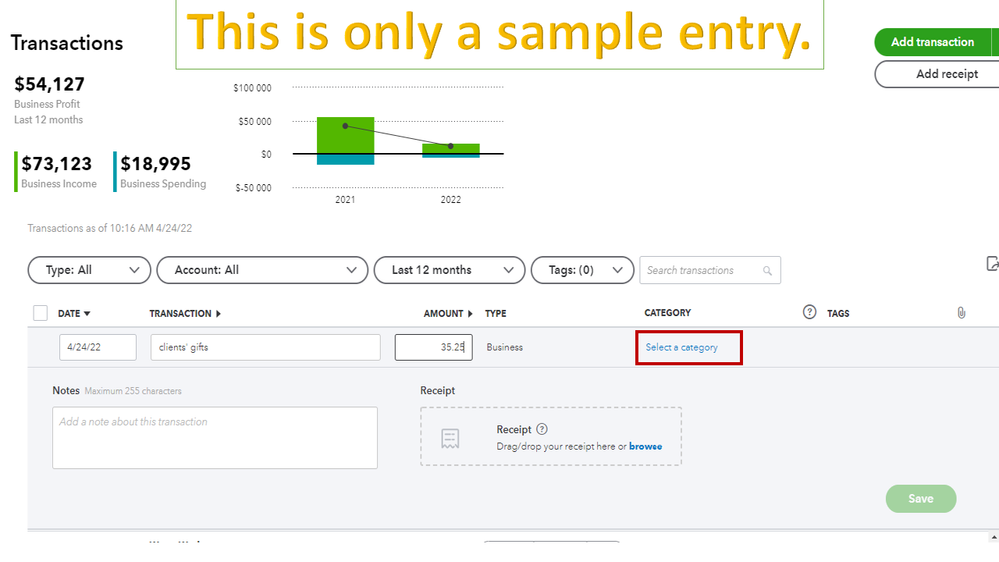

In QuickBooks Self-Employed (QBSE), you can input the items mentioned above on the Transactions page. For the specific Schedule C category, I suggest reaching out to your accountant. They can recommend which one to use and ensure it's deducting for gift tax. Follow the steps below on how to do this in your company.

- In QBSE, tap the Transactions menu on the left panel and click the Add transaction button.

- These steps will display a line time that lets you input the entry.

- From there, enter the amount type, and a description.

- Under the Category column, click the Select a category link and choose the best one that best fits the entry.

- Press the Save button.

You can browse this reference for more insights into this process: Manually add transactions.

For additional resources, this article will guide you on how to organize your income and expenses: Categorize transactions. Doing so lets you know what areas of your self-employed business have the biggest impact.

To learn more about the Schedule C and expense categories in QuickBooks Self-Employed, click here to view the guide. It contains a list of products or services that falls under each category type.

Click the Reply menu if you have any clarifications or questions about recording your items and other transactions. I’ll get back to answer them for you. Enjoy the rest of the week.