It's good to have you here in the Community, Kyosho. I'm here to help you edit a sales receipt to record a payment.

When creating a Sales receipt in QuickBooks Online (QBO), we can only choose one payment method to record a customer's payment. Thus, combining cash and credit card payments in a single entry is unavailable.

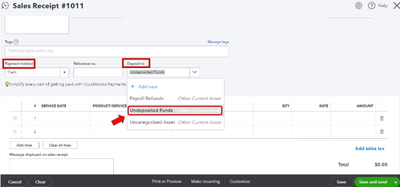

As a workaround, consider creating two sales receipts under one customer. This way, you can apply cash as a payment method and as a credit card on the other and deposit both receipts to Undeposited Funds.

I've added a screenshot below for your visual guidance.

Once done, proceed to make a bank deposit to record payment. Here's how:

- Go to + New.

- Create a Bank Deposit.

- From the Account dropdown, choose the bank account.

- Check the boxes of the sales receipts you want to deposit.

- Make sure to add cash and credit card under Payment Method.

- Hit Save and close.

I've added this additional resource to help you make a bank deposit in QBO: Record and make bank deposits.

Finally, to help you get insights on the status of your inventory, you can check out this article: Use reports to see your sales and inventory status.

Please drop a comment below if there's anything else we can help you with regarding sales receipts in QuickBooks. We'll be around to help.