Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hey there, @jlywelcome84.

Thanks for allowing QuickBooks to serve you with your accounting needs. I'd be happy to walk you through with adding paid invoices in QuickBooks Online.

You'll need to create an invoice and enter the original invoice date. Once done, you can link the deposit to the open invoice.

Let me show you how:

You can read through this article about creating an invoice in QuickBooks Online: How to create an invoice.

After that, you'll need to find the deposit and link it to the open invoice.

To do that:

You may also check out this article about linking a deposit to an invoice for your future reference: How to link a deposit to an invoice.

Here's a helpful link that you can visit about working with QuickBooks Online: QuickBooks Tutorials.

These resources should help you add your invoices.

Please know that you've got me here in the Community if you have any other QuickBooks concern. Wishing you and your business continued success!

Hi @jlywelcome84 ,

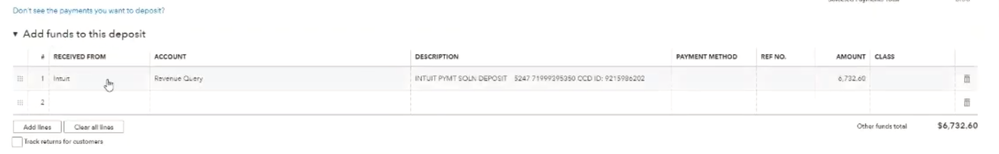

Hoping to help answer your question, Lynda and I created a video demonstrating how to add invoices into QuickBooks Online after the deposit revenue had already been accepted into the bank feeds.

Question Assumptions:

The Workflow Steps:

The Intended Goal:

The goal we are trying to accomplish from this step is to swap out the bank feed transaction amount with the new deposit that was just added when you applied payment to the invoice. This method will help ensure that you do not overstate your revenue by accident.

Note: It is very likely that you will run into deposits that have multiple check payments being deposited at the same time. In this scenario, it will be necessary to repeat this process for each check that was included in the deposit until the total of the checks matches the actual amount deposited into the bank.

Let us know if you have any additional questions or are unclear about any step of the process! We are here to help!

Lynda Artesani - Artesani Bookkeeping

Matthew Fulton - Parkway Business Solutions

Hi @jlywelcome84 :

On a side note, it is not a good practice to connect a deposit to an invoice. You want to connect it to the payment as an invoice is a "request for payment" but it is the customer payment that is deposited into your bank. Or match the deposit. But never the invoice.

@lynda Artesani

Artesani Bookkeeping

and

& Matthew Fulton @ParkwayInc

Parkway Business Solutions & Vendorsync

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here