Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowA warm welcome to the Community, info1649. Let me help you sort this out.

QuickBooks Online offers automation features, such as automatically applying payments to an open invoice.

If this feature is turned on and your customer has an available credit, this will automatically link to your open invoices and marking them as paid.

You can turn off this feature if you need to apply the payments to the correct invoice. Here's how:

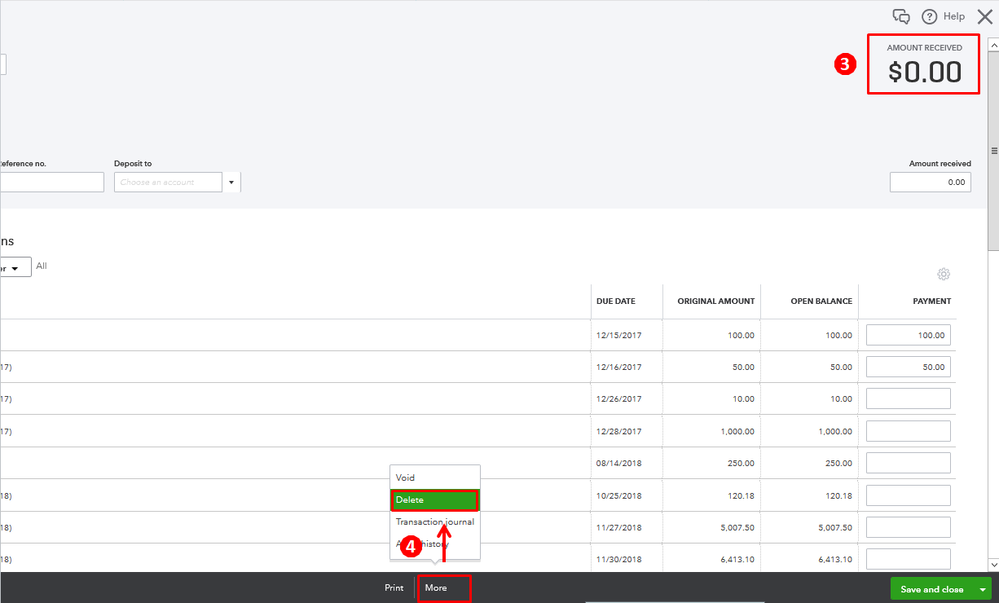

To unlink the payment, credit, or deposit to the invoice, see the steps below to complete the process.

Locate and open the new invoice.

To help you review your open invoices and customer's outstanding balance in QuickBooks, check out this article: How to Review Open Invoices and Send Payment Reminders and Balance Forward Statements in QuickBooks.

Leave a comment below if there's anything else we can help. I'll be right here to assist you with anything about QuickBooks. Have a nice day!

Hi. info1649.

Hope you're doing great. I wanted to see how everything is going about the previous payment showing on your new invoice. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here