We can set up a retainer to record your Merchant Cash Advance in QuickBooks Online (QBO), kearneyrexius. I'd be glad to guide you through the process.

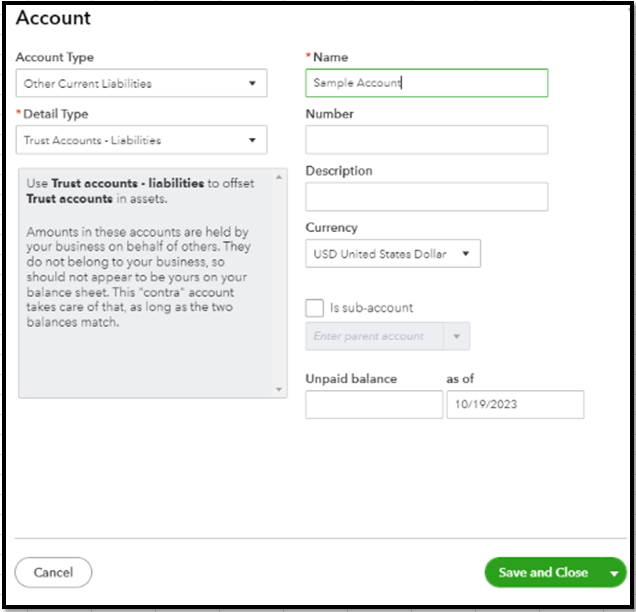

Let's start by creating a liability account to track the amount you receive from your merchant. Here's how:

- In your QBO account, go to the Gear icon and select Chart of Accounts.

- Click the New button and pick Other Current Liabilities from the Account Type dropdown.

- From the Detail Type dropdown, choose Trust Accounts - Liabilities.

- Enter a Name for the account and complete the required fields.

- Once done, tap Save and Close.

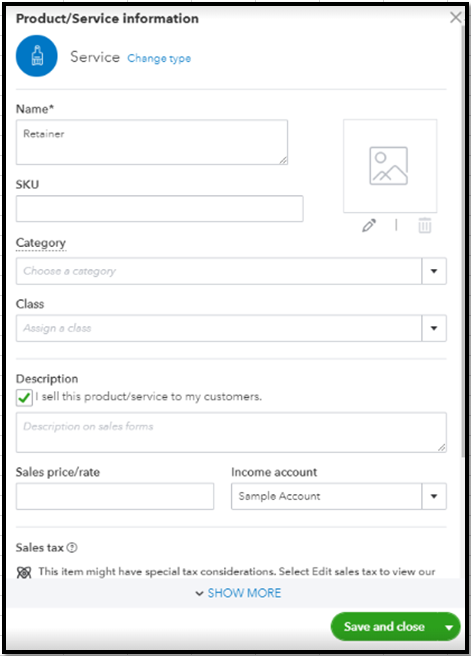

After that, follow the steps below to create a retainer item:

- From the Gear icon, select Products and Services.

- Click the New button and choose Service from the Product/Service information window.

- Enter a name for the new product or service item.

- From the Income account dropdown, pick the liability account created above.

- Hit Save and close.

Once everything's good with creating the account and retainer item, generate a sales receipt or invoice for the received cash advance.

Furthermore, you can manually include a line item for card processing fees on your invoices or sales receipts. Here's an article for reference: Manually add service fees to invoices in QuickBooks Online.

You can also seek assistance from your accountant if you need further guidance in choosing the proper accounts and other ways to record this better.

When you're ready to pay the cash advance, you can follow the Pay customer expenses with money held in the liability account section of this article: Record a retainer or deposit.

Drop a comment below if you have additional questions about recording cash advances. I'm always here to assist you.