Hi, @Plumn8tr.

I'm here to help you with checking your statement and Profit and Loss report.

QuickBooks is dependent on the data or transactions added into it. To get the correct comparison of your transactions, please make sure to set the date of your report same to your bank statement. Here's how:

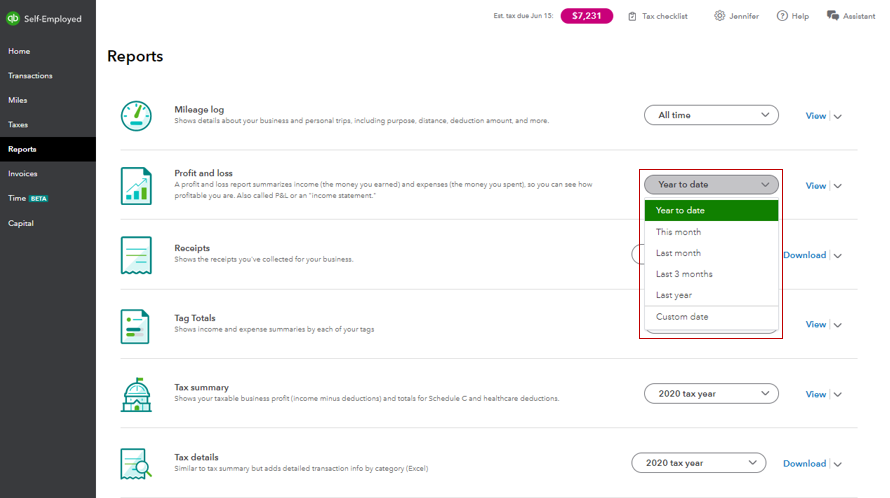

- Open your QuickBooks Self-Employed (QBSE) account.

- Click on Reports at the left pane, then go to the Profit and Loss section.

- Filter the dates to match it to your bank statement, then select View to open the report.

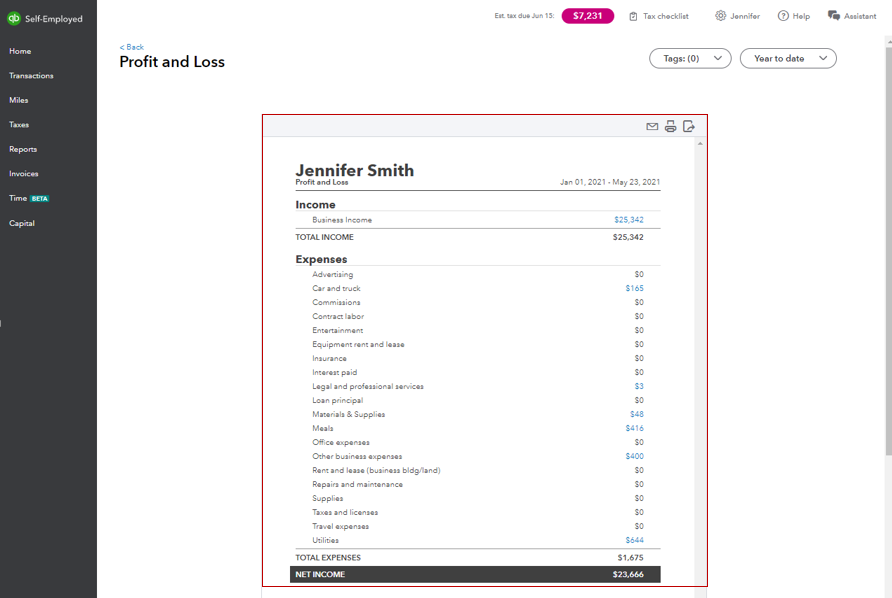

- Review the data from there.

If there are missing entries, you can add them manually. For your reference, you can open this link: Manually add transactions in QuickBooks Self-Employed.

And, here's how you can categorize your transactions based on the correct line of your Schedule C categories.

If you have any other questions about running your reports and handling your bank transactions in QBSE, please let me know by adding a comment below. I'm always here to help. Keep safe!