You can review your transactions to determine your capital investments, Hdhammond22. I'll discuss this matter thoroughly, including instructions on properly tracking these funds in QuickBooks Online.

Creating an estimated figure for the opening balance equity can lead to inconsistencies in your accounting records. Therefore, I suggest seeking the assistance of an accountant to review all transactions from the past two years in your personal account.

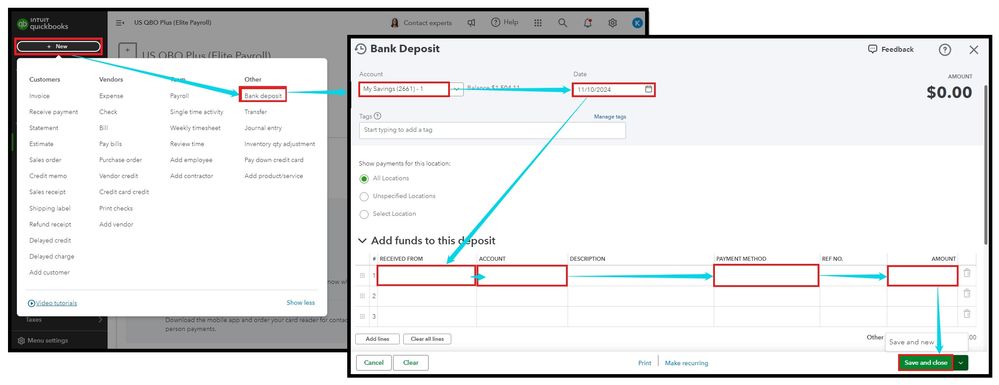

After that, you'll want to set up an equity account to track these amounts. If you're not connected to online banking, you can then create a deposit into this account with these steps:

- Click + New, then Bank deposit.

- Select the bank account into which the funds will be deposited from the Account drop-down.

- Specify the date from the Date field.

- Enter the investor in the Received from field in the Add funds to this deposit section

- Choose the appropriate equity account from the drop-down list in the Account field.

- Pick the Payment method, then key in the amount in the Amount field.

- Hit Save and close.

Otherwise, you'll want to categorize the transactions associated with your deposits to prevent duplicates.

Moreover, refer to this material for guidance on entering capital disbursement after you repay the funds from your investments: Record paying back an investment.

Please keep us posted if you need further assistance tracking the owner's investments in QuickBooks Online. You can always rely on us to provide the help you need.