Hey there, @Andreas D.

I'll share some information about the start up costs, so you'll be able to view them in the Profit and Loss report. Let me guide you how.

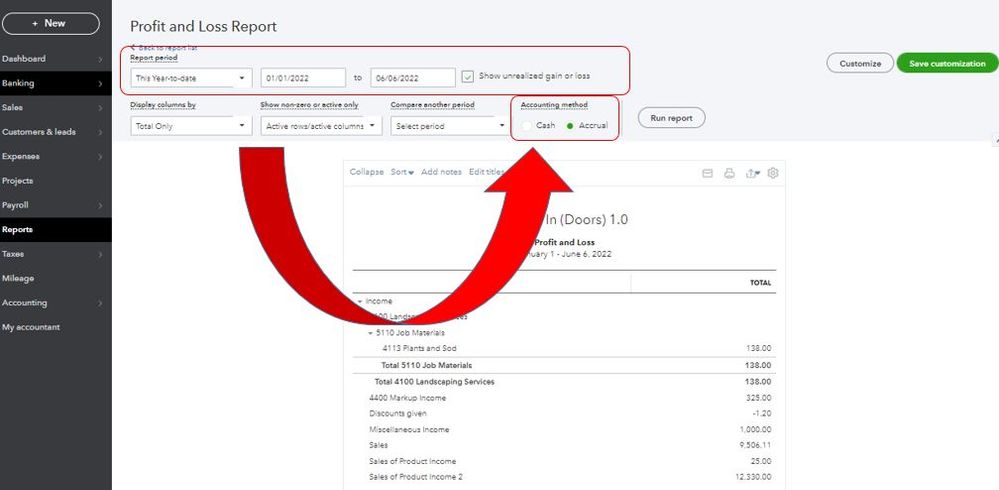

First, make sure you're viewing the correct report period. That should include the date of your start up costs expense transaction.

Next, check the accounting method if you're looking at the report as Cash or Accrual. Refer to the attached image below.

Lastly, make sure there are no filters in the report to ensure that all your income and expense accounts will be posted.

For more information about reports, check out these links below. It also includes our general report topics with articles:

Let me know if you have follow-up questions or concerns with start-up costs expense or with the Profit and Loss report. I'm more than happy to answer them for you. Take care and have a great day ahead.