Hello @tami-koepke,

Thank you for posting here in the Community. I'd be glad to help you enter the Check transaction in QuickBooks Online.

There are steps you need to perform to track the refund for the business expense. You'll need to enter a vendor credit and a bank deposit in this scenario.

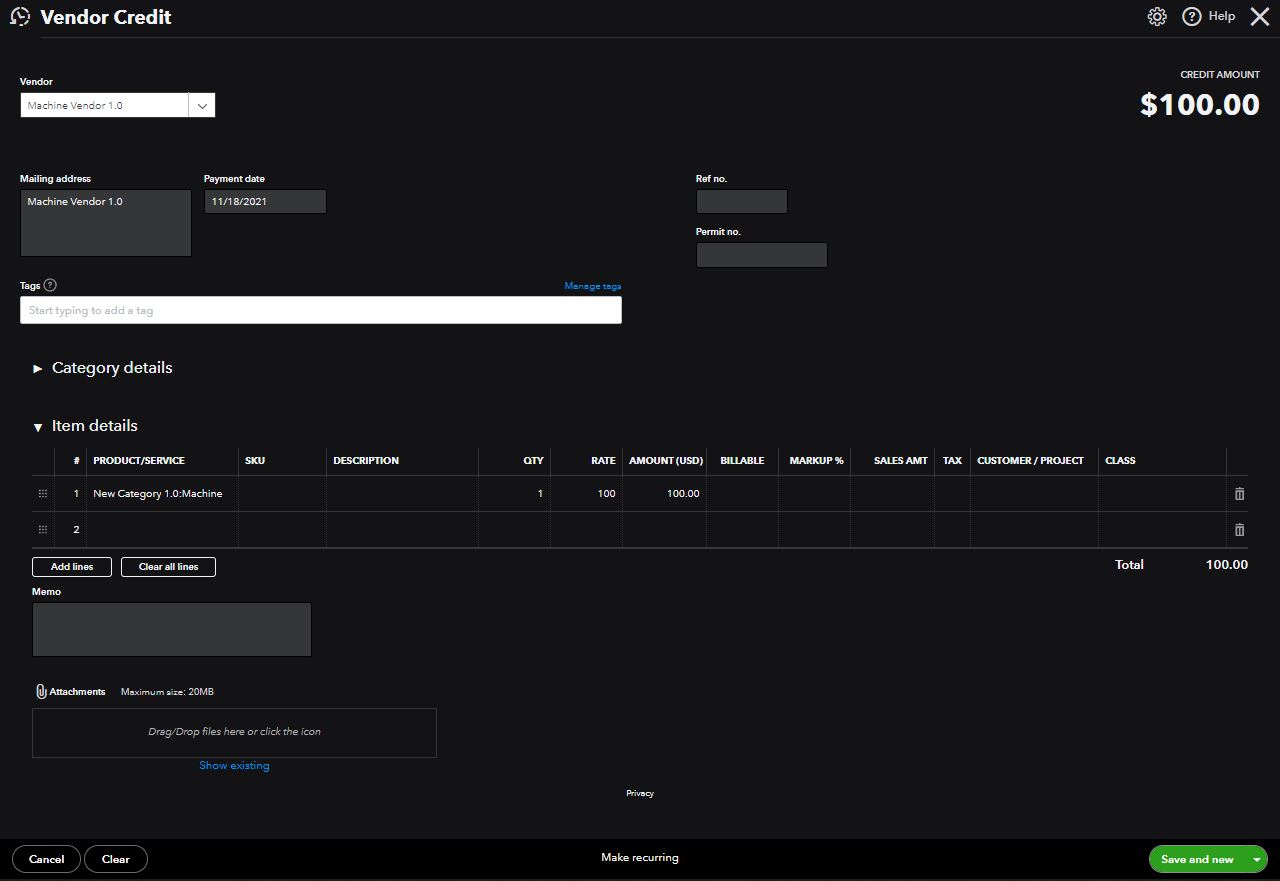

Here's how to enter a vendor credit:

- Click the + New option in the upper-left corner.

- Select Vendor credit or Receive vendor credit.

- In the Vendor dropdown, select your vendor.

- Depending on how you record purchases with this vendor, enter the Category details or Item details. Usually, this is the category, product, or service you’re getting a credit for.

- Select Save and close.

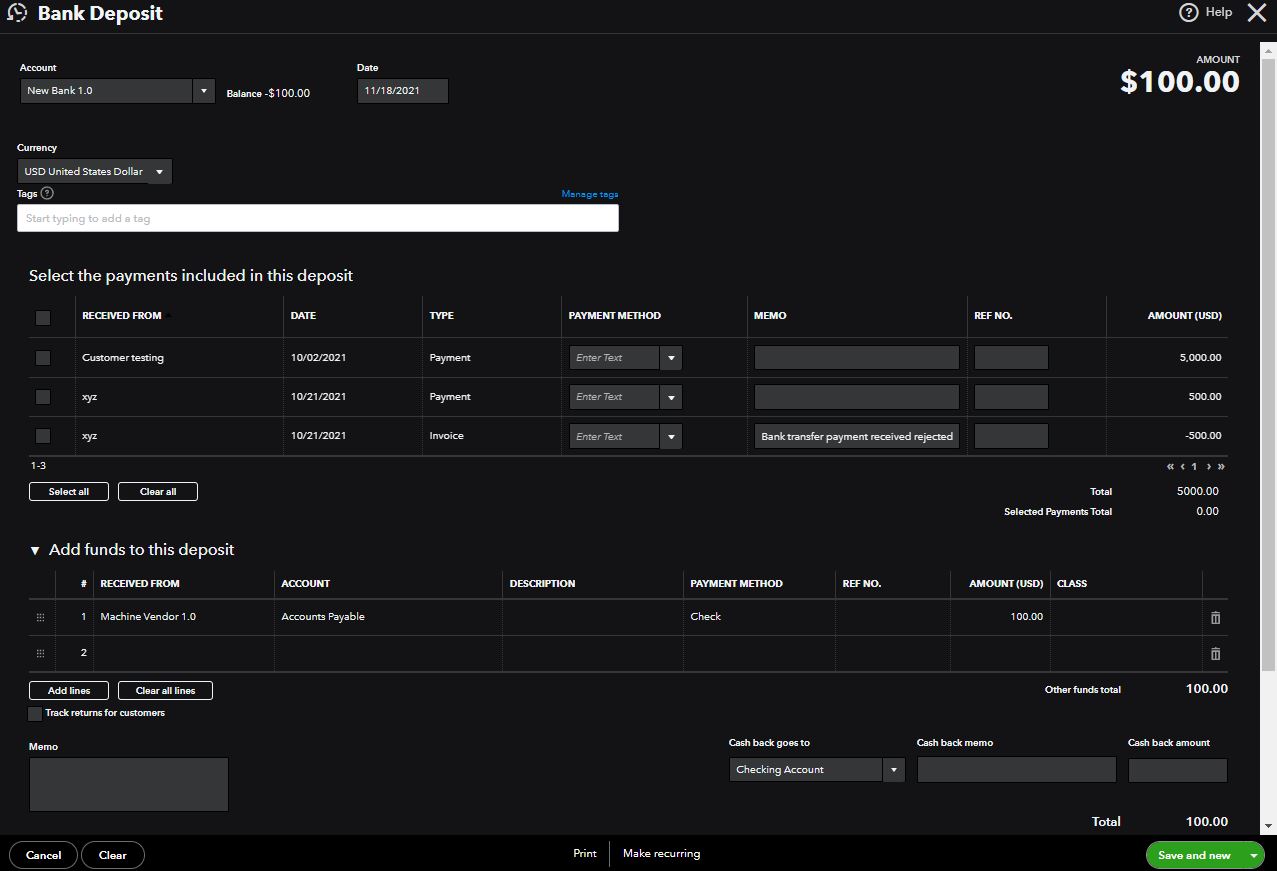

Once done, please deposit the check you got from the refund. Please follow these steps:

- Click the + New option in the upper-left corner.

- Select Bank Deposit.

- In the Account drop-down menu, select the account where you got the refund.

- Below Add funds to this deposit section, fill out the following fields.

- Received from: Select the vendor who gave you a refund.

- Account: Select Accounts Payable. Important: You need to pick Accounts Payable so you can tie the refund to the vendor credit. This may seem a little strange, but it’s the best way to do this.

- Payment method: Enter the method your vendor used to refund you.

- Amount: Enter the amount of your refund.

- Select Save and close.

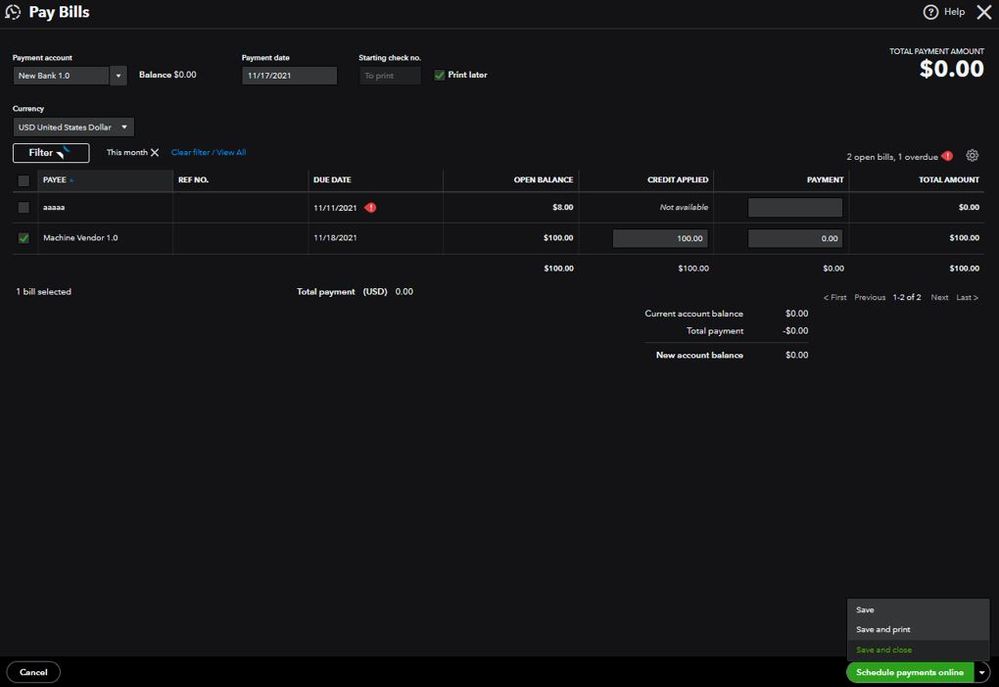

Lastly, the most crucial part of the process is linking both transactions. You'll need to use the Pay Bills feature for the next steps.

I know you aren’t paying a bill. This method will keep your vendor expenses accurate. Here are the steps:

- Click the + New option in the upper-left corner.

- Select Pay Bills.

- Choose the bank deposit you just created. You’ll see the amount of the vendor credit in the Credit Applied field. The Total payment should be $0.00.

- Select Save and close.

For additional reference, I've attached a link you can use to enter inventory quantity adjustment using the Plus or Advanced version: Adjust inventory quantity on hand in QuickBooks Online.

Keep us posted if you need anything else regarding the process of entering the check refund in QuickBooks. Have a great day.