Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, My name is Susie and I am the new inexperienced bookkeeper for our small church with less than 50 members at present.

We have purchased the QBO for nonprofits and that is what I am trying to set up now.

We have a checking account and a savings account.

I want to understand the chart of accounts correctly. I need to be able to designate certain amounts into various accounts that I know I will need to add each week. For example, offerings in one acct. Missions in one acct. Boys and Girls missions and so forth.

My concern is how do I do this correctly so those accounts each have their own starting amount?

I also will need to add an account for utility payments, and possibly more for other things that may come up down the road.

I would appreciate all and any advice here. I did purchase a book but it was for the desktop version instead of online. So I still plan to get the correct one, but I'm a little confused right now. Thank you in advance for your replies.

Susie

Hi Susie,

Setting up those account in the Chart of Accounts should be relatively easy and there is an area that lets you enter starting balances. I would Google Church financial statements to get an idea of where other churches were putting that information.

Offerings and Missions are Revenue accounts.

Utility payments are expenses.

Grab all the free spreadsheets offered in the following site:

Basic Accounting Tips for Churches and Nonprofits (freechurchaccounting.com)

Reach out to me if you have any further questions.

Let me welcome you first to the Community, Susie.

I know how important it is for your company to set up the correct accounts. This guarantees that your financial records are accurate. Let me point you in the right direction on how to properly handle your concerns.

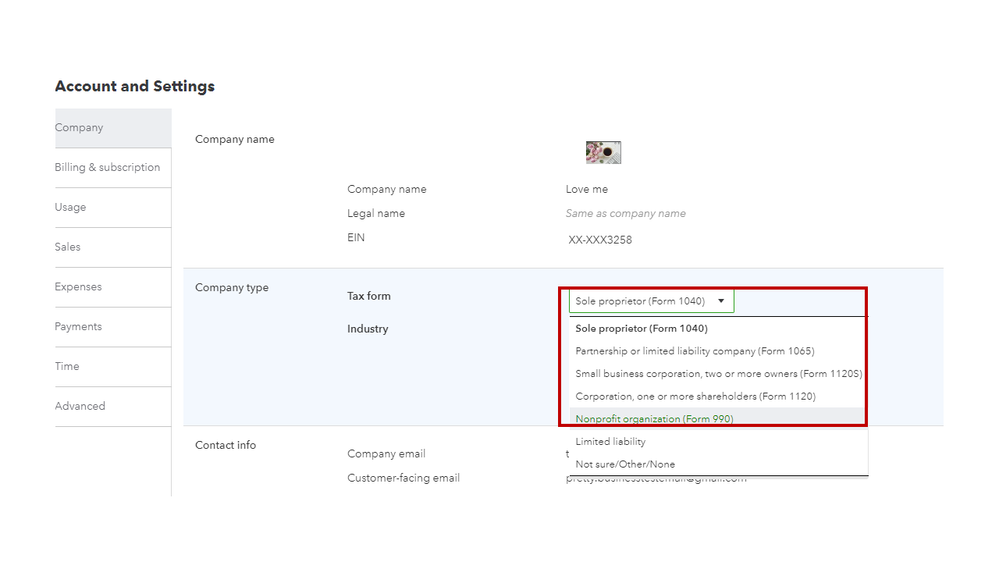

The online program automatically customizes your chart of accounts based on the nature of your business when you first set up your company. Also, there are specific default accounts that are created for you (based on the industry type). For a detailed list, check out this article: Manage default and special accounts.

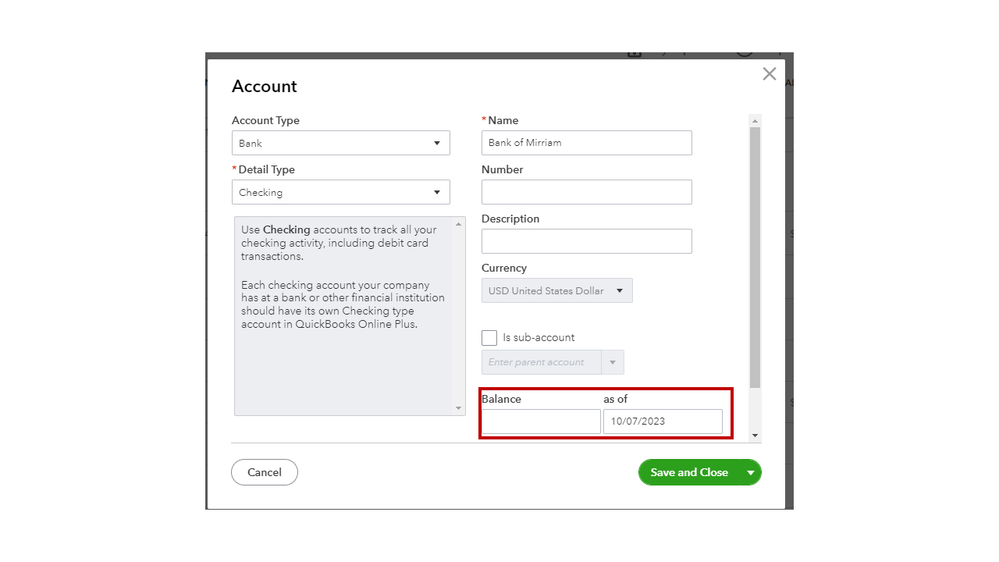

You can input the value in the Balance field to designate amounts to specific accounts.

I also recommend consulting with your accountant for further guidance. They can advise you on how to handle your accounting concerns, including the category to utilize for your debit and credit.

In case the Tax form type is incorrect on the Account and Settings page, you'll have to edit it and choose the right one. Here's how:

For the accounts created by QBO, inactivate the ones that you'll no longer use. If you wish to set up new categories, head to the Chart of accounts page.

Let me share these resources that tackle the importance of the chart of accounts as well as various account and detail types:

You browse the links below to help you get started in using the online program:

Reach out to me again if you have additional concerns about adding accounts to the register and other product-related questions. I'll get back to help you the best that I can.

Thank you so much for your reply. I only need to set us up with minimal accounts as I'll be entering manually for the time being.

What I'm not understanding, as I'm just a volunteer trying to get us up and running, and not an accountant or bookkeeper by trade, is this:

Lets say I have an account titled Offerings and Tithes. I want to set up sub accounts from that, such as our Boys and Girls Missions, Our regular missions, Sunday School, Worship Team, etc etc.

If I create those above, and enter a beginning amount for each, will they then all total the amount listed in the Account titled Offerings and Tithes?

Hi there, Susie. I'd be glad to answer your question.

Yes, when you enter transactions or amounts into the sub-accounts, they will be reflected in the parent account's total. So, if you enter amounts for each sub-account, the total of those amounts will be included in the balance of the "Offerings and Tithes" account.

See this screenshot below for your reference.

For further details about sub-accounts, you can check these articles:

You can also check this article for more information about fund accounting for non-profits: Fund Accounting for non-profits.

You can shoot me a reply if you have any other questions about setting up an account for your company.

Susie,

I've read your question and I'm in the same situation you are. Small church, volunteer, and no bookkeeping skills. How is Quickbooks working for you? I'm trying to decide if we want to go with this software program.

Any advice or suggestions?

Is Quickbooks receptive in giving assistance? Can you reach them by phone?

Would love to hear from you... Thank you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here