Welcome to the Community, Mleebel. I am here to ensure that you can properly process the credit card fee in QuickBooks Self-Employed (QBSE).

To start, if you want your customer to pay the invoice transaction fee, we'll have to manually add it to the invoice.

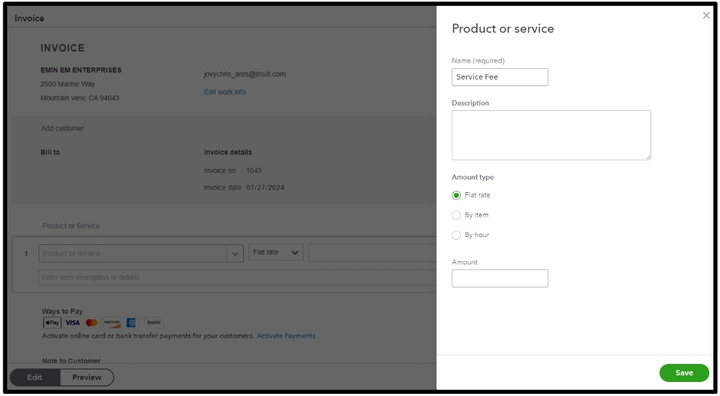

If you haven't already, let's create a service fee item:

- Sign in to your QuickBooks Self-Employed account.

- Select Invoices then, click on Create invoice.

- From there, hit on the Add product or service link, then select + Add new.

- Then, continue modifying the rest of the field and click on Save once done.

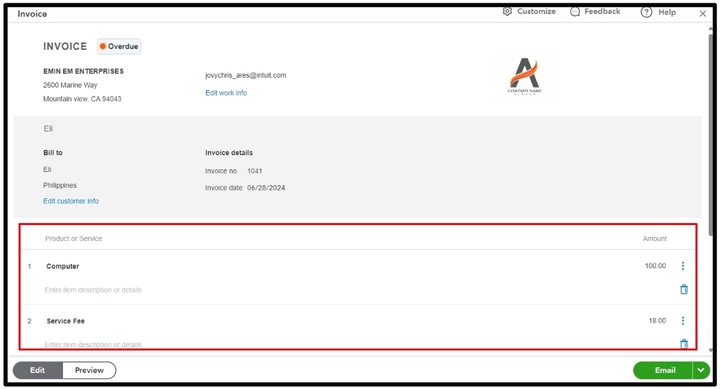

After this, if you’ve already sent them their invoice, create an invoice with the service fee. If you haven’t sent the invoice, make sure to add it before sending it.

Here's how:

- Go back to your homepage, then click on Invoices.

- Select the specific invoices you want to add a service fee.

- Once done click on Email then Send it to your customer.

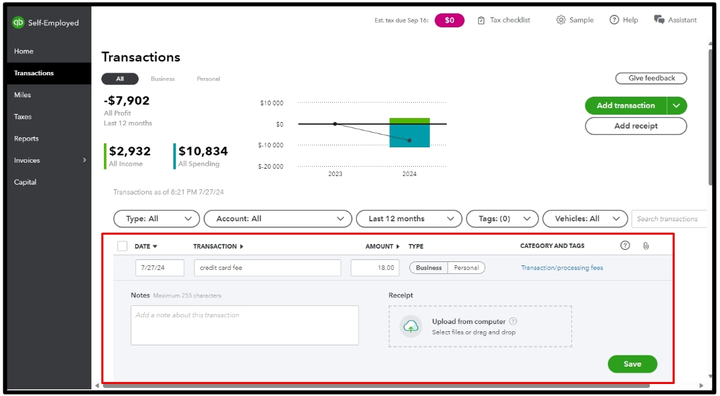

However, if you don't want your customer to pay the invoice transaction fee, you'll need to create an expense transaction to record it in QuickBooks, I'll guide you through how:

- Go back to your homepage again, then click on Transactions.

- Select Add transaction, then continue modifying the rest of the field.

- In the Type column choose Business.

- Click on the Select a category link, then choose Transaction/processing fees.

- Once done hit on Save.

Nevertheless, you can visit this article for future help on how you can categorize the transactions you download from your bank or enter into QuickBooks: Categorize transactions in QuickBooks Self-Employed.

Please don't hesitate to reach out if there's anything else you need help with managing your invoices in QBSE. I'll always lend a hand.