Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello!

I'm using QB 2006 on a PC in case that makes a difference... We collect monthly rent from our tenants. When they move in they provide a security deposit which I categorize under an "Other Current Liability" account. When they move out I refund the deposit minus repairs and maintenance costs if any.

Q1: If there are no repairs necessary, I issue a full refund so I just debit/credit (still don't understand that concept but we'll leave that for another time) the same other current liability account and it balances out. Is this correct?

Q2: How would I record a refund while subtracting expenses for repairs? I attempted a journal entry but it became a hot mess!

Thank you!!!

I'll guide you in handling that transaction, M4MU.

Yes, that's correct. You'll have to refund the full amount of the security deposit or retainer on the same liability account. If there are any expenses, you can deduct them from the total amount of the security deposit.

Once your customer decides to move out, you can create a refund check in QuickBooks to reimburse the upfront deposit. Here's how:

I'm also adding these articles to help manage your upfront deposits and rental property transactions in QuickBooks Desktop:

If I can be of any additional assistance, please don't hesitate to tag me in the comment section. Have a great rest of the day.

Hi M4MU,

Hope you’re doing great. I wanted to see how everything is going about your concern yesterday. Were you able to record the refund? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Thank you KlentB for taking the time to provide the thorough process and follow up! We are still a little old school here and handwrite paper checks. I record the checks by clicking on "write checks" on the "home" screen. Any chance you can provide another explanation going that rout? For example, when we write checks to mortgage company, I split the full amount into two accounts: the liability acct for the principal portion and the loan interest account for the interest portion. So I'm wondering if it's possible to split the customer refund check the same way. Thanks!

Hello again, @M4MU.

I appreciate you for adding more details about your refund concern. I’m here to guide you in the right direction on how to resolve the issue.

The option to split a refund check is currently unavailable. We have alternative solutions on how to handle this type of situation.

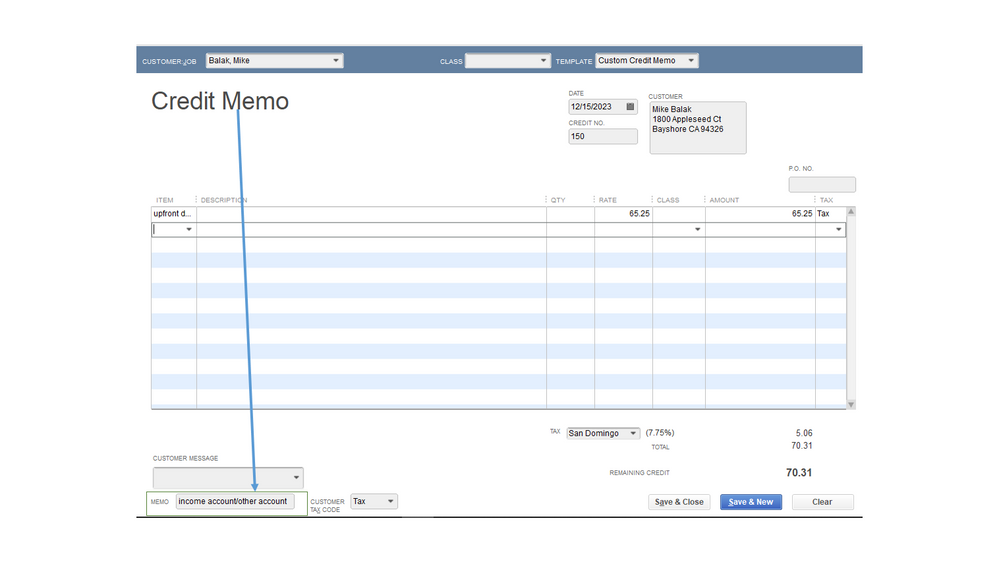

First, you can create two credit memos for the transaction. For detailed instructions, I still recommend following the steps shared by @KlentB. Another way is to utilize the Memo field and add the accounts associated with the entry.

Here’s how:

For future reference, I’m adding a link that provides detailed information on how to apply a credit or refund to your customers. Tap here to view the complete details of the guide. It includes instructions on how to perform the task in your company file.

Also, this resource contains articles to help get acclimated to the tasks you can do in QuickBooks: Get started. Choose the topic to view more information.

Drop a comment below if you have any clarifications about handling customer refunds. I’ll be right here to answer them for you. Wishing you and your business continued success.

Thank you for the additional help! I need to enter a check with a corresponding check number. Also I'm using 2006 version on a desktop so it looks like I'll have to figure out a way (probably journal entry) to balance the Current Liability account after I deduct expenses.

I have a similar situation - and when I follow your directions to refund a payment - the "open balance" goes from -25K (the amount I am refunding) to -50K (double the refund). Why doesn't it zero it out?

Welcome to the Community, @SLIM1104.

Thanks for joining this thread. To ensure we're on the same page, could you tell me the exact steps you've followed? That information is a great help so I can provide a timely solution.

In the meantime, you can use this article as reference in managing upfront deposits of your customers: Manage upfront deposits or retainers.

I'll be waiting for your response. Have a good one and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here