Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've been using QB to manage rental properties for my mother since my father passed away last year. He taught me a lot but I'm by no means an accountant. One of the original tenants has offered to do some work on his unit. Considering he was on the original crew that built the building we decided he was qualified and allowed him to do the work and told him we would take an amount off his rent equal to the work performed. I record rent checks as deposits into an income account per unit. This month his rent check was less the agreed amount for the work. How do I record the discounted portion properly? If I record it as subcontractor work in the "record deposits" window then it simply takes the amount out of the "Subcontractor" expense account and deposit it to the checking account. Thanks!

Also, I'm running a Windows version of QB Desktop Pro 2020.

You've got all the help you need here, RobertFarrell.

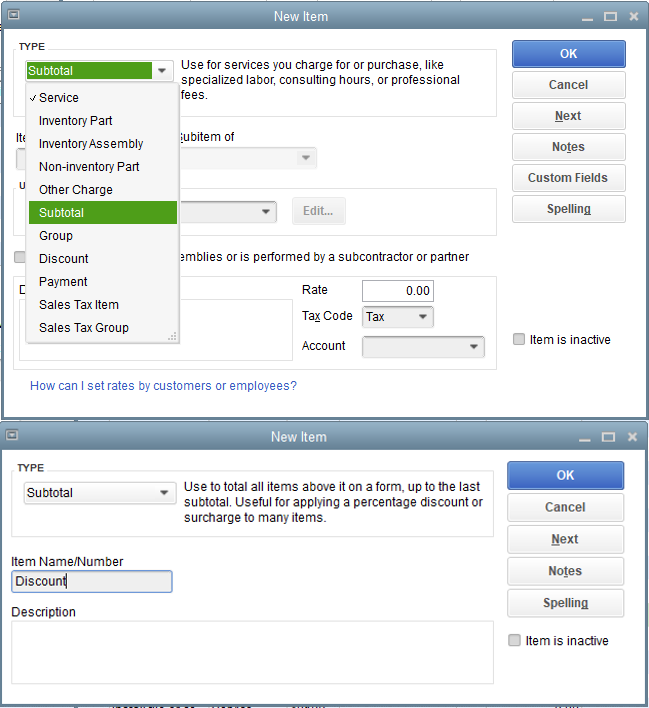

The first step is to create a discount item to use when you record the rent. I'll show you how to do it below:

You might find this article helpful when creating an item in QuickBooks Desktop (QBDT): Add, edit, and delete items.

Once done, you can apply the item to the transaction. There are two ways to record the rent from your tenants and it depends on when you receive the actual rent payment.

To record the rent income in QuickBooks:

For more detailed instructions on how to record rent income in QuickBooks, please click this article: Record transactions for a property management company.

Feel free to visit our QuickBooks Help Articles page for more insight s about managing your business in your software.

I'm still around if you need more help recording your rent in QuickBooks Desktop. Have a good day ahead.

Hi, RobertFarrell.

Hope you’re doing great. I wanted to see how everything is going about recording rent discounts. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

Thank you for your help, Charies. I have not had an opportunity to revisit this yet.

I appreciate the guidance and will be referring to your steps.the subtotal discount item makes sense to me, however I'm afraid I've been recording income incorrectly. My father taught me to record it using the "deposit check" function and simply select the account for the assigned rental unit. He never, nor have I, used invoices or sales receipts. We simply have tracked it as an income in an income account. I'll have to do some reading on your guides but I may need help, that seems confusing.

Thank you

Rob

I appreciate the guidance. I haven't had a chance to sit down and revisit this yet.

The discount subtotal item makes sense but I fear I've been recording rent income incorrectly. My father taught me to use the "deposit check" function and assign the monies to an income account assigned to each rental unit. Is this incorrect? I've never used invoices for rent nor sales receipts.

The simple recording of checks as income misses the big picture and does not illuminate you on who may not have paid their total due each month. All you are doing is recording money deposited as if it is all income.

To make your life easier there are some tasks that you can automate to start with.

Create an initial Invoice for each tenant for monthly rent and any other charges. Memorize the invoices and have them post 10 days prior to billing date (Rent due on 1st you want the invoice dated the 1st to be in the books early in case you want to send out rent invoices as a reminder.

Then when you record checks you record them as Receive Payments. No other action required other than creating the bank deposits.

Use Sales Receipts primarily for receiving security deposits and application fees

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here