Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe recently converted our Sage 50 data to QuickBooks. One of the issues we need to clean up in our QuickBooks data is related to the way Sage handles customer credit memos vs. QuickBooks.

Here is some background on how Sage does this to provide some context.

To enter and process a customer credit memo in Sage, the following is required:

1. Enter customer credit memo referencing the customer account and the items/values

2. Create a "Payment" record to show the outgoing money to the customer (DEBIT to AR Sales, CREDIT from Cash Account)

3. Process a "Receive Money". This step matches the Customer Credit to the Payment and closes the process

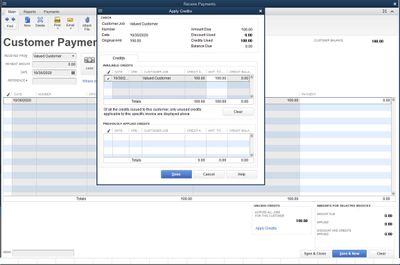

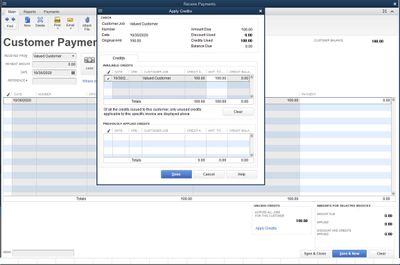

When the data was converted from Sage 50 to QuickBooks, I now have the Customer Credit Memos appearing (representing step 1 above) and also a "Check" payment showing (representing step 2 above). However, these appear on our AR Aging report (as 0.00 amounts because the negative credit amount and positive check amount cancel each other out - see screenshots) and I would like to clear those up so they don't appear on the AR Aging report anymore.

Is there a way to match these two transactions together to emulate step 3 above? It's ok if not, but I do need to know how to get these transactions to disappear from my AR Aging report.

Can someone feedback on what I can do to clear these transactions up?

Solved! Go to Solution.

I've got your back, @ChiColorLabel. I've got the steps to match these two transactions together to emulate step 3.

To get the amounts off the Accounts Receivable Aging Summary report, we'll have to apply the credit to the payment using the Receive Payment feature.

Here's how:

Refer to these articles to learn more about running an A/R Aging report and how to write off uncollectable balances:

I've also included these links that will guide you on how to handle customer and vendor credits:

Get back to me if you have other concerns about applying credits. I'll be around to answer them all for you. Keep safe and have a good one.

I've got your back, @ChiColorLabel. I've got the steps to match these two transactions together to emulate step 3.

To get the amounts off the Accounts Receivable Aging Summary report, we'll have to apply the credit to the payment using the Receive Payment feature.

Here's how:

Refer to these articles to learn more about running an A/R Aging report and how to write off uncollectable balances:

I've also included these links that will guide you on how to handle customer and vendor credits:

Get back to me if you have other concerns about applying credits. I'll be around to answer them all for you. Keep safe and have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here