Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello Community,

My client would like to transition from manual invoicing to invoicing directly within QBO. Client wants to maintain accrual basis records. Many of the invoices cover multiple accounting periods. A recent invoice dated 10/10 covered July, August and September services rendered. How can this best be accomplished in QBO?

My current understanding is that the invoice date is what drives the accounting period for the sale, but this sale would need to pick up the invoice line item level in order to accurately put the revenues in July, August and September. The invoice date should be October 10 because that is the date it was sent to the customer but that is not the correct accounting period for any part of the sales revenue. Going forward, the same would be true - we would be invoicing in the period after the services are performed, so invoice date will not be accurate to use for for accounting period.

If QBO is incapable of picking up a different field than the invoice date, the best idea I can come up with is to generate an invoice, say, Invoice #55 in October 2022 covering July-Sept, so that the customer has a single invoice with all 3 months reflected, but then do a credit memo in QBO to zero out the October revenue and enter in three more invoices: 55-1 for July, 55-2 for August, and 55-3 for September, and attach the PDF version of Invoice 55 as a document for reference, and when the customer payment is received, apply it against invoices 55-1, 55-2 and 55-3.

That seems like a lot of extra work just to get the accrual periods correct. I know it would work, but I'm hoping there's a better way.

Thanks for the help!

That's a fantastic idea, @Anonymous.

I appreciate the alternative methods you've shared above for generating invoices with multiple accounting periods. It seems to benefit you and your business. However, this is currently unavailable.

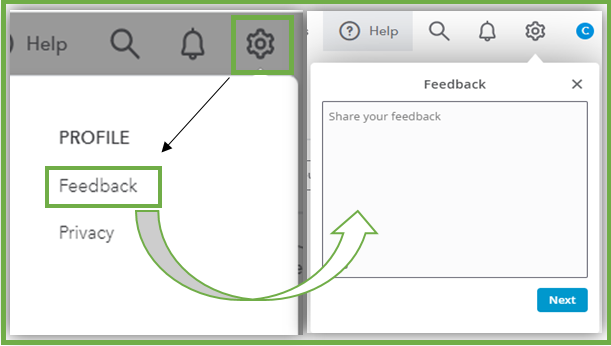

Please know that we’re constantly taking your suggestions while making product updates to enhance our customer's experience with program features while using QuickBooks. This would be a great time to send this suggestion directly to our Product Development Team. Thus, they can review and determine what features to add for future product enhancements. Here’s how:

The more requests this gets, the more likely it'll be part of future enhancements. To track the progress of your feature request, feel free to visit our Feedback forum.

In the meantime, you'll want to visit this article that will help you account for your customer payments in the future: Receive invoice payment.

Stay in touch if you have any other questions or concerns with managing your invoices or want to share your best practices using QuickBooks Online. I'll be around for you. Enjoy the rest of the day.

Thank you for confirming the feature I am looking for does not yet exist, and for appreciating the workaround I came up with. I also appreciate you pointing me to the way to leave feedback for future QB versions.

Thank you for confirming that the feature I am looking for doesn’t yet exist and for pointing me to where I can suggest it for a future QB version. I also appreciate the quick reply and your compliment about my workaround.

@AnonymousI believe there could be created an automation for the workaround you invented. Please reach us at https://crm.accountants/contact if you are interested. Thank you.

Thanks for following up with the Community, JLN25.

I'm happy to hear Carneil_C was able to help provide information about what's currently possible in QuickBooks and how to submit feature requests.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply here or create a new thread if there's ever any questions. The Community's always here to help. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here