Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am looking for some help on sales tax payable and sales tax liability trying to understand if I need to do a JE for these transactions. The way I was instructed to enter sales tax payable was to enter a check for expense allocating expense to sales tax payable and B&O tax, there is nothing I am entering to sales tax liability. There is no balance in sales tax liability and a balance in sales tax payable. Is there a JE for these type of transactions?

I am just learning how to do this and want to be sure I am creating and balancing the accounts correctly.

Thank you

Solved! Go to Solution.

Thanks for coming back for more support, @MP11. I'm here to help you record your taxes to easily monitor and remit them to the appropriate tax collecting agency.

First off, make sure you check the tax rates and requirements with your tax agency. Then, let's turn on this feature and set up sales tax items or tax groups. Here's how:

For more insights on adding the sales tax item/sales tax group, refer to step 4 in this help article: Set up sales tax in QuickBooks Desktop.

To make sure your books are accurate, I'd recommend you consult your accountant or tax professional.

Feel free to message again if you have additional questions. We're always delighted to assist.

Hello, @MP11.

I can share some information on how to record your sales tax payable and pay your sales tax liability.

Using the Write Checks or Pay Bills feature to pay your sales tax will lead to errors in your bookkeeping and sales tax reports. You can run the Account Quick Report and filter Checks to get removed them more easily.

Here are the steps:

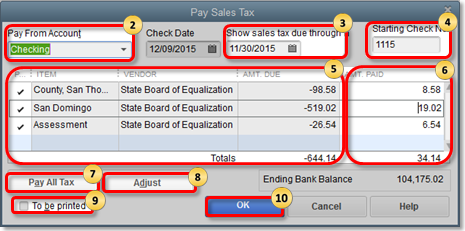

Once completed, you can follow the steps below in paying your sales tax in QuickBooks.

Lastly, if you encounter problems while working on your sales tax, you can check this article:

Sales Tax Liability Report and Pay Sales Tax window do not match

Resolve common issues when running Sales Tax Liability Report

Keep in touch with us here in the Community to us know how it works on your end. I'm always here to help you with running your sales tax liability report.

Thank you for the detailed instructions. I am now working on running the reports. I do have another question is the B&O Tax entered in the sales tax screen or is that a separate entry in Quickbooks?

Thank you

Thanks for coming back for more support, @MP11. I'm here to help you record your taxes to easily monitor and remit them to the appropriate tax collecting agency.

First off, make sure you check the tax rates and requirements with your tax agency. Then, let's turn on this feature and set up sales tax items or tax groups. Here's how:

For more insights on adding the sales tax item/sales tax group, refer to step 4 in this help article: Set up sales tax in QuickBooks Desktop.

To make sure your books are accurate, I'd recommend you consult your accountant or tax professional.

Feel free to message again if you have additional questions. We're always delighted to assist.

I have the sales tax set and its capturing sales tax. Am I just added the B&O tax as an item and when I pay monthly through pay sales tax it will be a line item I can add?

Hello there, @MP11.

Let me step in and share with you the information after adding the sales tax item in the line item.

You can select the sales tax you want to pay by putting a checkmark beside them. Once done, make sure you fill up all the necessary fields in the Pay Sales Tax windows. Then, hit the OK button to confirm the action.

You can follow the steps provided by my colleague IamjuViel as your reference in paying your sales tax. Or, you can refer to this article for more detailed information: Pay sales tax in QuickBooks Online.

I also added an article in case you need help adjusting your sales tax: Process sales tax adjustment.

If you have follow-up questions, please don't hesitate to leave a message in the comment section. I'll be around here in the Community to help. Keep safe, and have a great day.

I have followed the steps I've come across where the sales tax window shows we paid $626.76 the STLR and what we paid was $1059.44. I've checked the data and its all correct and should reflect what we paid. I looked through all the steps listed on what to check if there are differences and can't find any. The sales tax window is clearly wrong our sales tax for the month was much higher. How do I correct this?

Thank you

Hi there, MP11.

You'll want to process sales tax adjustment to increase the sales tax amount you paid.

Also, here's an article for your reference about multiple sales tax items on an invoice. It would also be best to reach to an accountant so they can better guide you regarding sales taxes.

I'll be here if you need more help. Stay safe and healthy!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here