Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI can share some insights about how you can effectively handle sponsorship ads in QuickBooks Online, treasurer-newbos.

Yes, the correct approach is to create a regular invoice for each sponsor for the costs associated with the ads. Then, recording a payment after. Please be reminded that the payment date will depend on the actual date of receipt.

Once the event is over, you can handle the payment of 80% to the contract entertainment provider by recording a barter transaction and keeping the 20% revenue. Here’s how:

First, set up a barter bank account

Next, create an invoice and record the payment. Please note that Before recording your barter transaction, ensure that you have added your barter partner as both a vendor (for the bill) and a customer (for the invoice). Since it is not possible to have the same name in both lists, make a slight variation in one of the names.

Create an invoice:

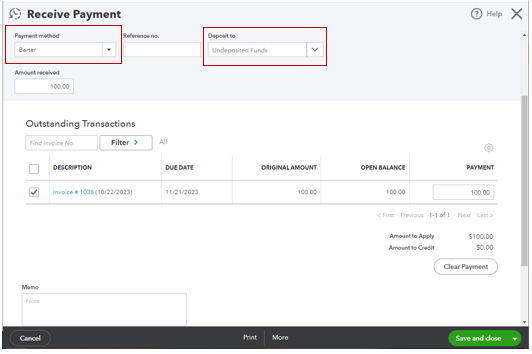

Record an invoice payment:

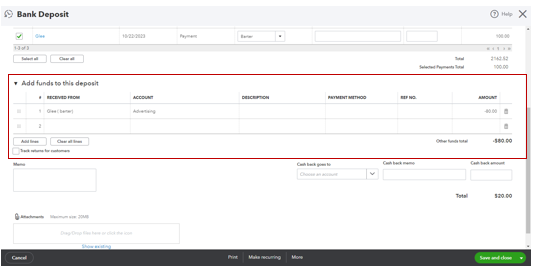

Lastly, generate a bank deposit, and in the section for Add funds to this deposit, input a negative value representing 80% of the amount to be paid to the vendor, while retaining the remaining 20% as income in your account. I've attached screenshots for your visual reference:

Furthermore, it's also a good idea to consult with an accountant to ensure accurate recording and proper handling of these transactions based on your specific business needs.

If you have questions or need further help managing your account or related issues, reply to this thread. I'll be ready and waiting to assist you again.

Ignore @GlinetteC 's response. It is so very wrong and it will mess up your books.

"1. Do I invoice sponsors as a normal invoice?"

It depends on whether you're on cash or accrual basis. If you're on cash basis, then the payments are income when received so the invoice should have items that are mapped to an income account.

If you're on accrual basis, the invoice should have items that are mapped to your 'Deferred Revenue - Event XYZ' liability account. Or, you can put items on the invoice that are mapped to an income account and then move the income to Deferred Revenue with a journal entry after the invoices are created (debit Income, credit Deferred Revenue - Event XYZ'). You will need to move that back to income when the event occurs.

"2. When they pay how do I record payment?"

Go to New > Receive payment, just as you would for any other invoice.

The 20% in expenses you pay out to the contract entertainment provider next August will reduce your net income to 20%. Hope that helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here