Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I use QB desktop and have it set up as a cash basis accounting method for reporting.

Should expenses on my report for Profit and Loss for a month equal the expenses on my bank register report for a given month? They never seem to equal the exact amount in any given month. Is it likely that I am doing something wrong or it to be expected that they don't exactly equal each month...?

Solved! Go to Solution.

RE: Should expenses on my report for Profit and Loss for a month equal the expenses on my bank register report for a given month?

No. You can expect the summary and the detail profit and loss reports to agree, but that is all. Other reports report on other things, such as "sales" and "purchases", which are not the same thing. Similarly any report oriented around one account, like your bank register, won't by nature include all of the same information as a P&L, and will probably include some that is not on a P&L.

Hi there, kb111,

The Profit and Loss (P&L) report shows the individual transaction of your income, expenses, and net income regardless of the bank in the register. While your bank register is another way around.

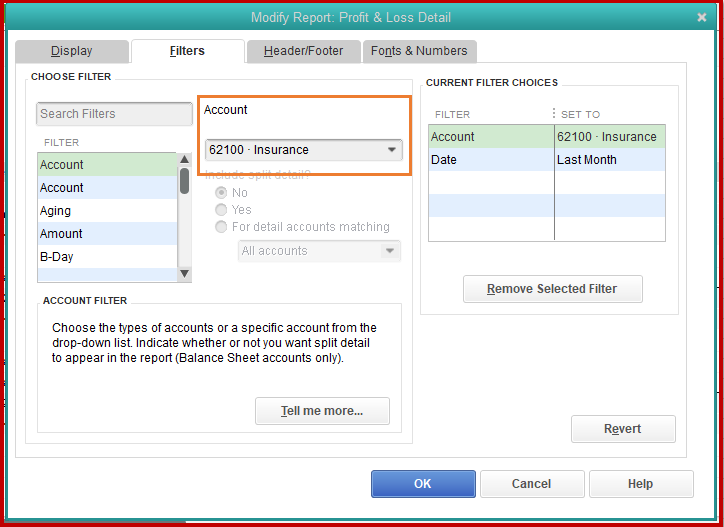

I've got it right here on my end where an expense on the Profit & Loss (P&L) report should show the same amount with one on your bank register. See the attached screenshot below for your visual guide.

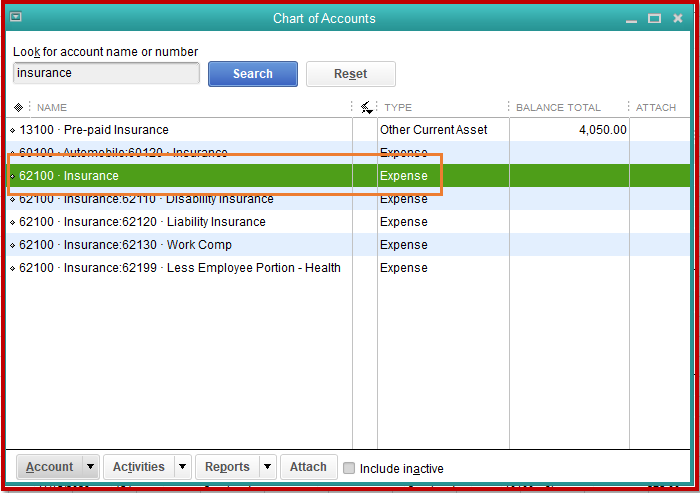

Just make sure you've pulled up the same account to get the results. Let me show you how:

Open the expense account through the P&L report:

Open the expense account through the bank register:

Check out the Customize company and financial reports to learn more about getting the data based on your needs.

You can also memorize the report so you won't have to go through the customization process again.

Let me know if you need additional information, and I'm always glad to help you out.

RE: Should expenses on my report for Profit and Loss for a month equal the expenses on my bank register report for a given month?

No. You can expect the summary and the detail profit and loss reports to agree, but that is all. Other reports report on other things, such as "sales" and "purchases", which are not the same thing. Similarly any report oriented around one account, like your bank register, won't by nature include all of the same information as a P&L, and will probably include some that is not on a P&L.

Absolutely agree. For example loan principal or payment on a credit card are not expenses when paid. And until an account is reconciled one cannot rule out that not all expenses or income is actually recorded

Thank you so much for your explanations! They were very helpful!

Thank you for explaining further! That makes more sense now.

Thank you so much for your response. I feel better about things now!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here