Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI would like to show VAT on the total of my invoice, but the only way I can show it at present is to add it to each line. (I charge an hourly rate, and I have to show an hourly rate that has VAT added)

How can I have it to be calculated on the total amount, rather than show it on each item?

Hey tmccar

You can only add it to each line, as you may have scenarios where you have multiple lines, each with a different VAT code.

The total VAT for the invoice is calculated based on the entirety of the VAT across the whole invoice, giving you a total VAT in the bottom right hand corner of the invoice.

You can also use custom form styles to change what information you want the invoice to show, if you want to use this route.

Thanks,

Good day,

Is there perhaps a way for VAT to be worked out by the net total of everything sold?

There are 12 different VAT options to choose from and with an invoice list where we sell around 20 items it can sometimes lead to choosing the wrong VAT option for one of the items.

Hello there, @YYC.

You've got me here to help share some information about how VAT works in QuickBooks Online.

You have the option to enter directly the VAT amount of your sold items instead of having QuickBooks to calculate the amount for you. However, you still need to select a VAT code so Quickbooks will determine the box on your VAT return to post the amount.

You can do this by creating an invoice which is exclusive of tax, then select 20.0% S as the VAT Code. Once done, you can now edit the subtotal amount. Please see the screenshot below to visualize the process.

Here are some good references that you can check out about handling VAT in QuickBooks:

If you need further assistance in setting this up, feel free to reach out to our Customer Care Team. They have advanced tools that can help you with the entire process.

Please let me know if there's anything else you need concerning VAT. I'll be around for you. Thank you!

Thank you @BettyJaneB

Hi,

I added vat rate to invoice but when i give print preview it shows 'total tax' but i want it to show 'total vat'. how can i edit/change it?

i understand it but when i give print preview it show "Total TAX" but I need to show "Total VAT" here, Could you please suggest me how can i change it??

Thanks for chiming in on this thread, @christofar.

Currently, the option to change the TOTAL TAX text to TOTAL VAT in your invoice is unavailable. In the meantime, look for a third-party app that lets you customize your invoice templates. While I'm unable to recommend an app, I can direct you to the website where you can look for an application specific to your business needs: QuickBooks App Center.

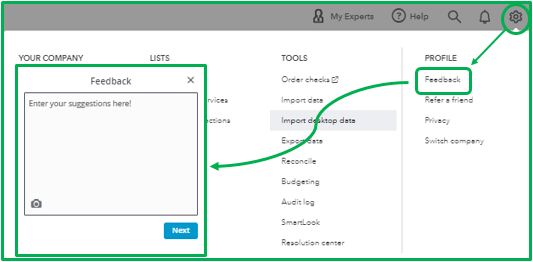

Nevertheless, you can send this request to our Product Development Team to help improve your experience. They'll review your suggestions and make some necessary adjustments in the next update to ensure we're meeting the needs of our customers. Here's how:

Additionally, you can check out this article to learn more about how to personalize and add specific details to your invoice and other form styles: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Please don't hesitate to reply to this thread if you have any other questions regarding managing your invoices in QBO. I'll be here to lend a helping hand. Stay safe!

This change from Total TAX to Total VAT, is it going to be made available at any time soon?

Thanks for joining the thread, @peersb.

For now, we are still waiting for updates from our developers with regard to changing the TOTAL TAX text to TOTAL VAT when creating an invoice.

Please know that feature enhancements depend on the number of requests sent to our developers. The more feedback request they'll get, the greater the chance it will be implemented in future updates.

If you haven't sent any suggestions yet, I'd recommend doing so. That way, they can review your feedback and help us improve your experience in QuickBooks.

Aside from that, you can track feature requests through our QuickBooks Online Feature Requests website.

Need more help? Just leave a comment below and we'll respond as soon as we can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here