Thanks for coming in the Community, @dalt2573.

With the new automated sales tax in QuickBooks Online, it automatically calculates the total tax rate for each sale based on the following:

- Your customer's tax-exempt status

- Where you sell and where you ship

- Your service or product's tax category

The tax agency and rate will depend on the customer's address. You can check the location set up on the customer profile. Then, enter the correct address to allow QuickBooks to calculate taxes correctly.

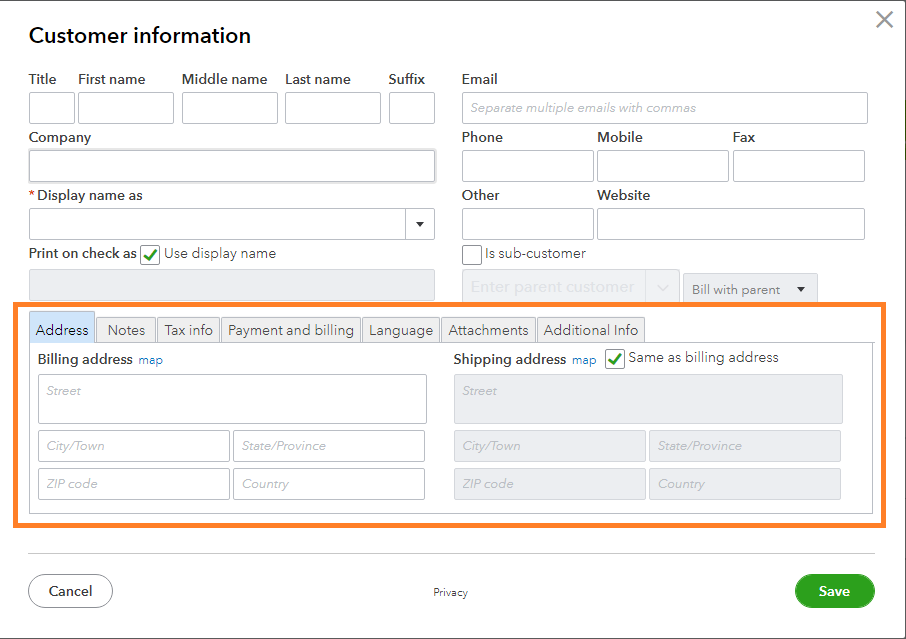

Here's how to verify the address:

- Go to Sales from the left menu, then Customers.

- Open the customer profile, then click Edit.

- On the Customer information window, go to the Address tab.

- Enter the correct billing and shipping address.

- Click Save.

You also have the option to adjust the sales tax on an estimate, an invoice, or a sales receipt.

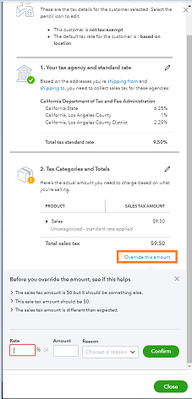

- Open an estimate, invoice, or sales receipt.

- Choose a customer.

- Enter the necessary info.

- Put a checkmark on the box under Tax column.

- Click the See the math link (highlighted in blue).

- On the Your tax agency and standard rate, you'll see the sales tax calculated by QBO.

- Under the Tax Categories and Totals section, click the Override this amount link.

- Add the rate or amount of the adjustment.

- Select the reason for the adjustment.

- Click Confirm, then Close.

Let me also share these additional guides when filing and paying your sales taxes in QBO:

Additionally, you can run the Sales Tax Liability report to view your sales tax info anytime.

Let me know if you need any more help setting up your sales tax. I'm always here to help.