Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy now1. Cannot categorize credit card payment in expense transactions

2. When generating profit & loss statement, the sales income didn't appear

Please kindly help

Hi there, Nadia123.

You've mentioned that you are using credit card payments. This is why they cannot be categorized as expense transactions and will not appear in your Profit and Loss statement. Let me explain the details further.

Credit card payments are usually recorded as a transfer of money from your bank account to your credit card account. They are recorded as cash flow transactions between accounts and do not directly affect your Profit and Loss statement.

However, since these payments are transfers to settle previously recorded obligations rather than new expenditures, they do not directly impact the profit and loss statement, which is intended to track income and expenses within a specific period. Instead, the individual purchases made with the credit card influence the profit and loss statement, categorized under appropriate expense accounts at the time of the transaction.

When generating your P&L report, it's essential to consider your accounting method. Cash-basis accounting logs transactions at the time payments are received or made. On the other hand, accrual-basis accounting records income and expenses when invoices are issued or bills are received.

Additionally, allow me to add this resource to help you record payments to your credit cards in QuickBooks Online: Record your payments to credit cards in QuickBooks Online.

Furthermore, I'm adding this resource for future reference on reconciling your accounts, so they always match your bank and credit card statements: Reconcile an account in QuickBooks Online.

We're committed to making your financial management with QuickBooks smooth and effective. If you have any more questions, feel free to leave a post. We're here and ready to assist you promptly.

So, the credit card payment is only recorded as current liability and not recorded as expense in profit & loss statement? How about the sales that didn't appear in the profit & loss statement?

Thank you for coming back, Nadia123. Yes, you are right about how the credit card payment is recorded in QBO. Let me explain why the sales did not appear in the Profit & Loss report.

Here are the possible reasons why sales did not appear in the P&L report:

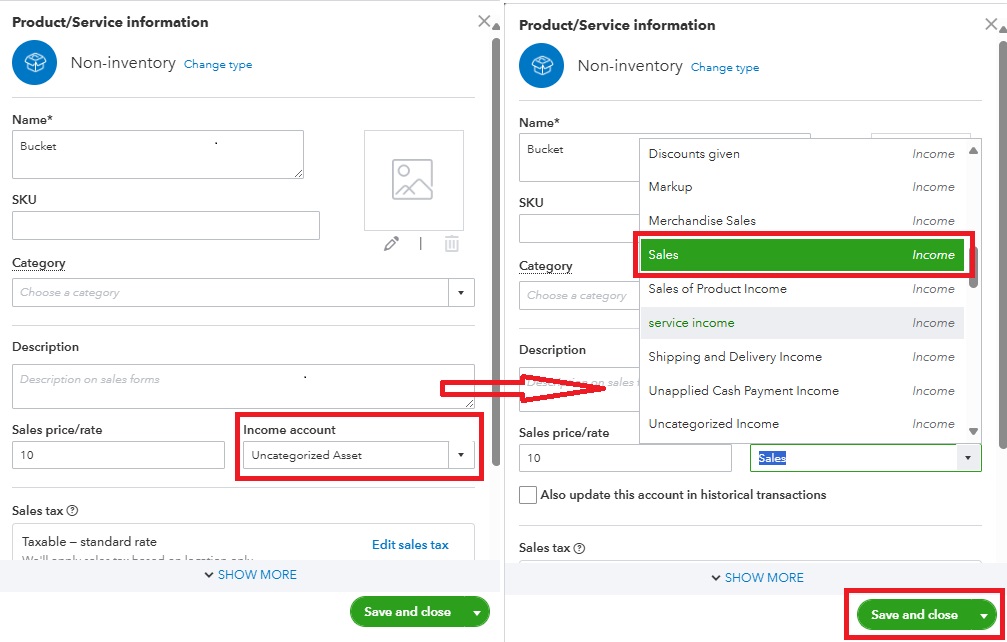

It's important to ensure that the dates of the transactions match the reporting period, as this can affect the reporting. Also, let's check if the associated income account of the item is correctly categorized in the income account; if not, it won't appear in the P&L report.

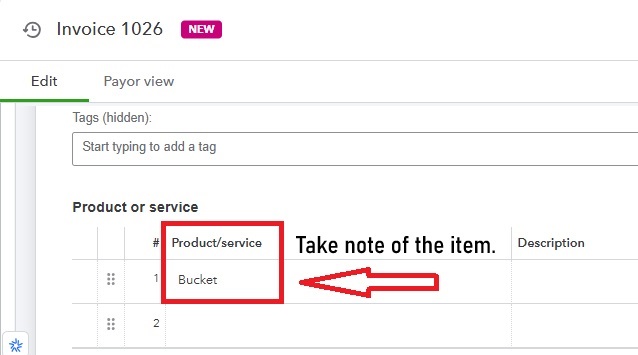

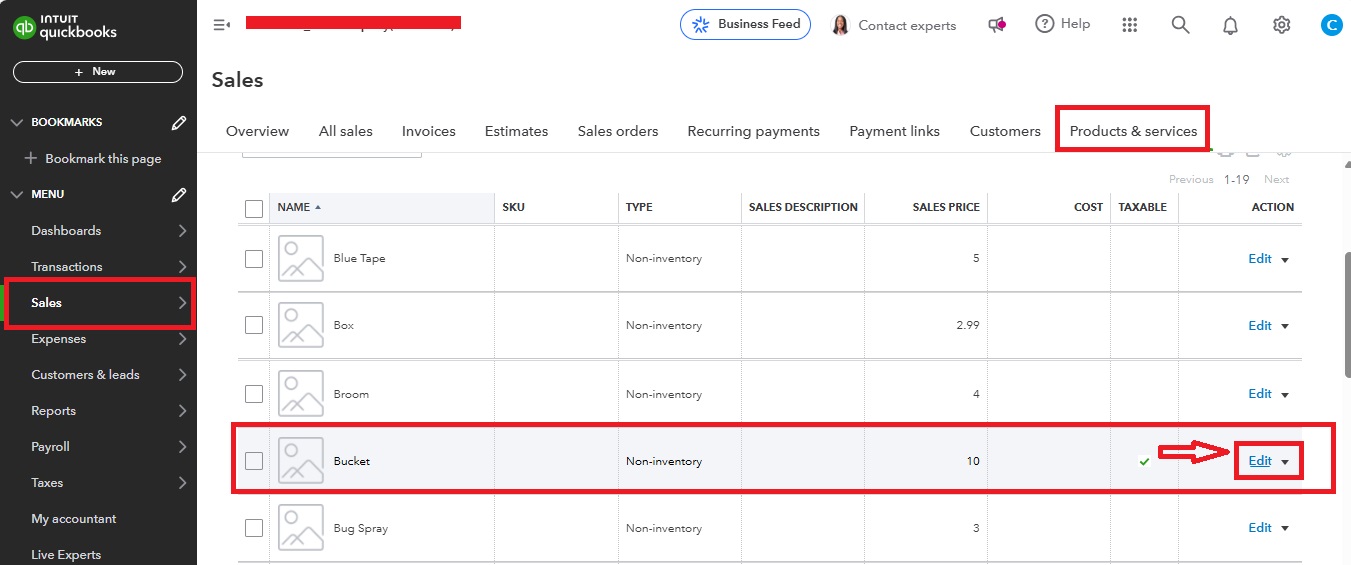

Here's how you can check the Income account:

Associating the items with the correct income account is important as this can affect our reporting in QBO.

Additionally, when running the P&L report, please check the accounting method used. The cash accounting method records transactions when payment is received or made, while the accrual method records income and expenses when invoices are sent or bills are received.

If you want to export your report to Excel from QBO, please refer to this resource for more information.

If there's anything else you need, feel free to come back. The Community team is always here for you. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here