Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowI need to change my Unbilled Costs by Job Report to show materials that were returned.

For instance, we purchased $500 worth drywall for a job. When we received the receipt, it was marked as billable to the customer while entering it into the register. However, we later returned a $200 worth, and it was marked as billable to the customer (and again, marked as billable when entering it into the register)

When I pull the Unbilled Costs by Job Report, it is only showing the initial charge for $500, and isn't showing the second transaction for the -$200.

I've checked the filters on the report, and I'm not seeing where I can select the option for it to show this.

It does show when I go to add the expenses to the customer's invoice ($500 for the initial charge, -$200 for the returned materials)

Definitely an issue. I turn the Unbilled Costs by Jobs Report in to my manager and don't want him thinking I'm not charging the right amount for materials. Currently, I'm having to pencil in these returned item transactions to make sure he knows I'm not off my rocker. :)

Thanks for sharing this with us, ebo8302.

Let's sort this out and investigate why your returned materials worth $200 didn't show on the Unbilled Cost by Job report.

When making a return, ensure that the transaction created for the refund uses the correct name of the Customer: Job. This is one of the factors why it's not showing in the report.

To review this, find the transaction using Audit Trail and follow the instruction below:

Should you need more information about managing refunds, check out this article: Give your customer a credit or refund in QuickBooks Desktop for Windows.

Also, to help me better isolate this issue, I'd like to know how you record the return or refund in QuickBooks Desktop. This can also be the reason why the $200 return is not showing in the report.

If you need tips and related articles in your future tasks, visit our QuickBooks Community help website for reference: QBDT Self-help.

I'd appreciate any additional details that you can provide and I'll take it from there. Let me know if you have other questions. I'm here to help.

When I enter in the transaction, I'm going under the "splits" screen, checking the "billable" box, and entering in the customer's name.

Not sure what else I would need to do.

Hello there, @ebo8302.

You're on the right track when making the returned materials billable. However, it will not show in the Unbilled Costs by Jobs Report.

Though, we can run the Job Profitability Detail report for that specific Customer:Job to see the initial charge and return.

Here's how:

You can also check this article about understanding reports in QuickBooks Desktop (QBDT).

Fill me in if you have other questions. I'm always here to help. Take care!

I am having the same difficulty with credits not appearing in "Unbilled Cost by Jobs" reports. The odd thing is the credit does not appear on the "Unbilled Cost by Jobs” if it’s on the checking account (credit to checking). However, if the credit is made on our Amex that credit appears in “the Unbilled Cost by Jobs”. I feel this inconsistency should be investigated. I am crediting the correct customer. We are a very small business and tracking is not that difficult.

I have noticed this for years actually and just got curious and investigated today. I have to manually remember to write it into our report. I want to keep track of the part of the job that is unbilled. We are not interested in the profit and therefore the other reports are not as suitable for our goals. I’d greatly appreciate it if you could investigate a way around this discrepancy since it works for Amex but not for the BOA checkbook.

I am using the 2019 Desk top version of quickbooks

Hello there, mmagui1.

First, may I know what type of transaction you entered? Is it an expense or bill? This will help me better isolate your concern about the missing credit from your checking account in the Ubilled Cost by Jobs report.

Let's fix this by deleting then recreating the transaction to toggle it. Before doing so, make sure to secure a copy of the transaction's information.

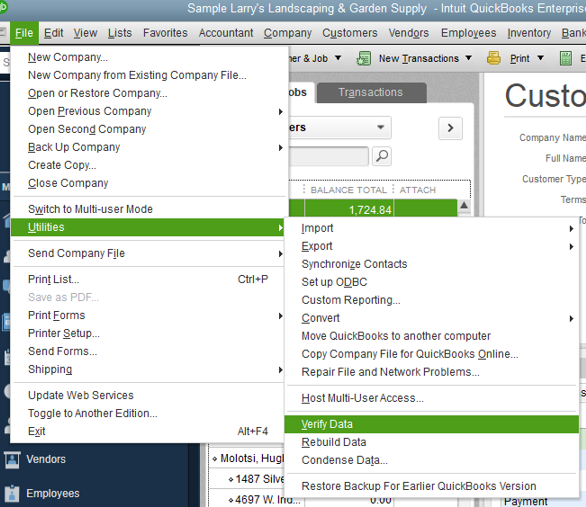

Locate the transaction using the Audit Trail. I'll show you how to do it:

Then, you can recreate the transaction and go back to the Unbilled Cost by Jobs to see how it works. If not, we can try some basic troubleshooting using the Verify and Rebuild Utility Tool. This helps trace common data damage within your company file.

Below are the steps on how to do this:

The Community is always open if you have other questions. I'll be around to help. Wishing you a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here