It's good to see you here in the Community, Melbel136.

Helping you show the refund to your credit card is my priority.

You can record a Credit Card and a Vendor Credit to offset the original amount of the item that is being refunded, and to show this transaction on your card.

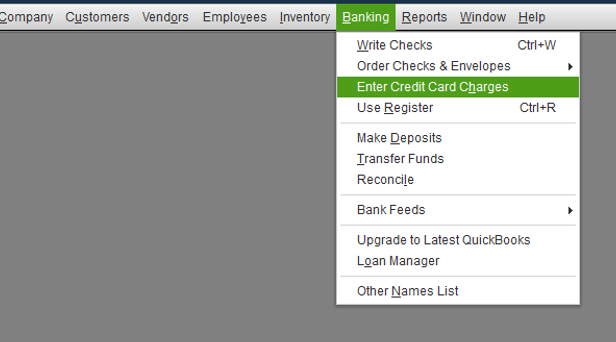

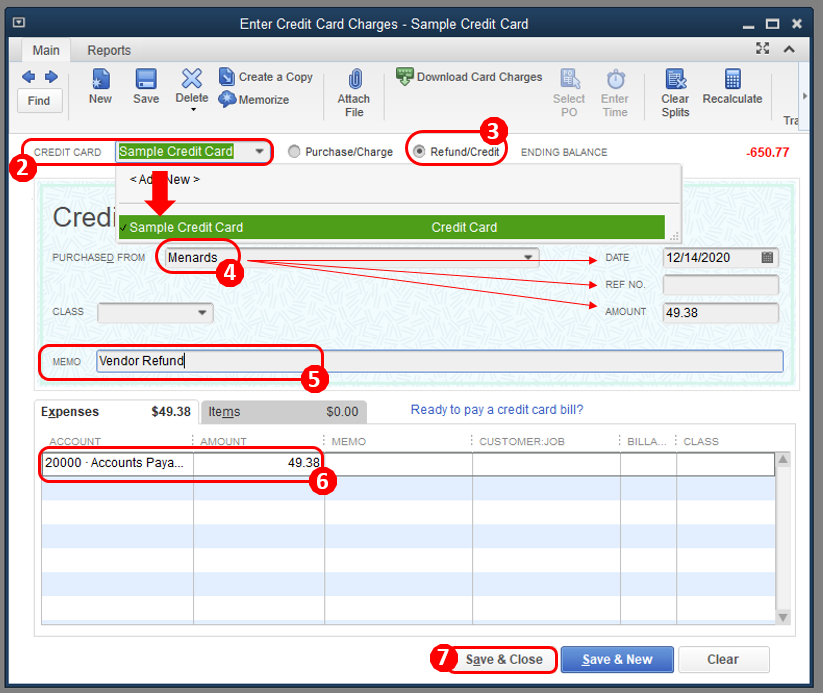

To record a credit card credit:

- Click Banking at the top menu bar and select Enter Credit Card Charges.

- From the Credit Card drop-down, select the credit card account.

- Select the Refund/Credit radio button.

- Choose the appropriate Vendor name and enter the Date, Ref No, and Amount.

- Enter an appropriate memo to describe the transaction.

- Since doesn't include an item, select the Expenses tab. choose the appropriate Account and enter the Amount.

- Hit Save & Close.

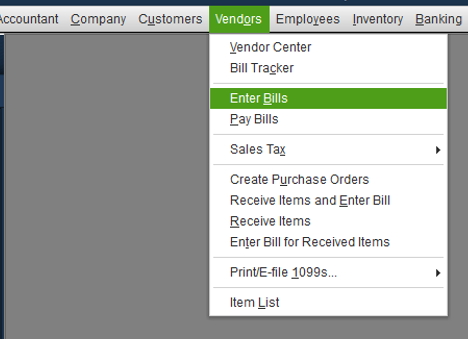

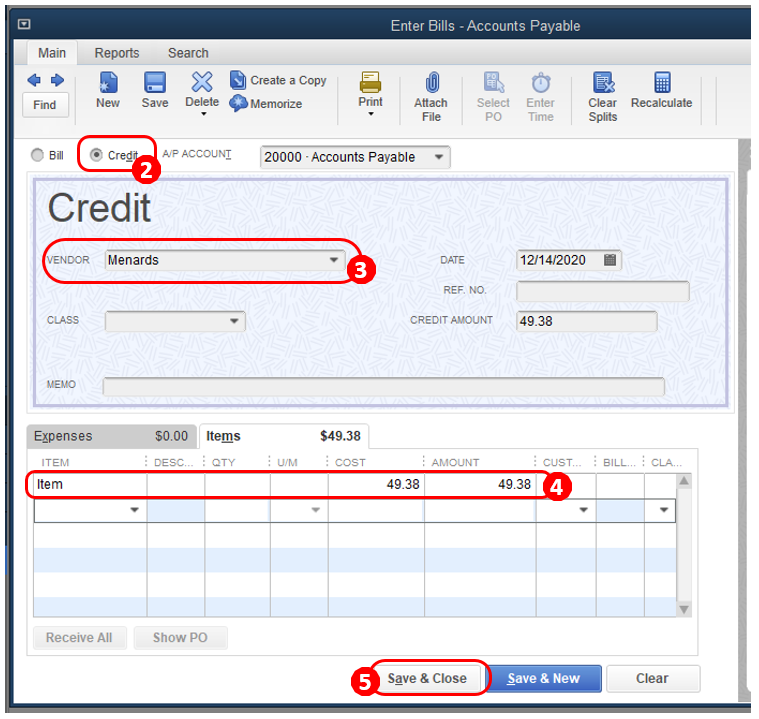

Here's how to enter a vendor credit:

- Click Vendors at the top menu bar and select Enter Bills.

- Select the Credit radio button to account for the return of goods.

- Enter the Vendor's name.

- Choose the Item from the original bill and enter the Amount (refund).

- Hit Save & Close.

Link the credit card credit to the vendor/bill credit:

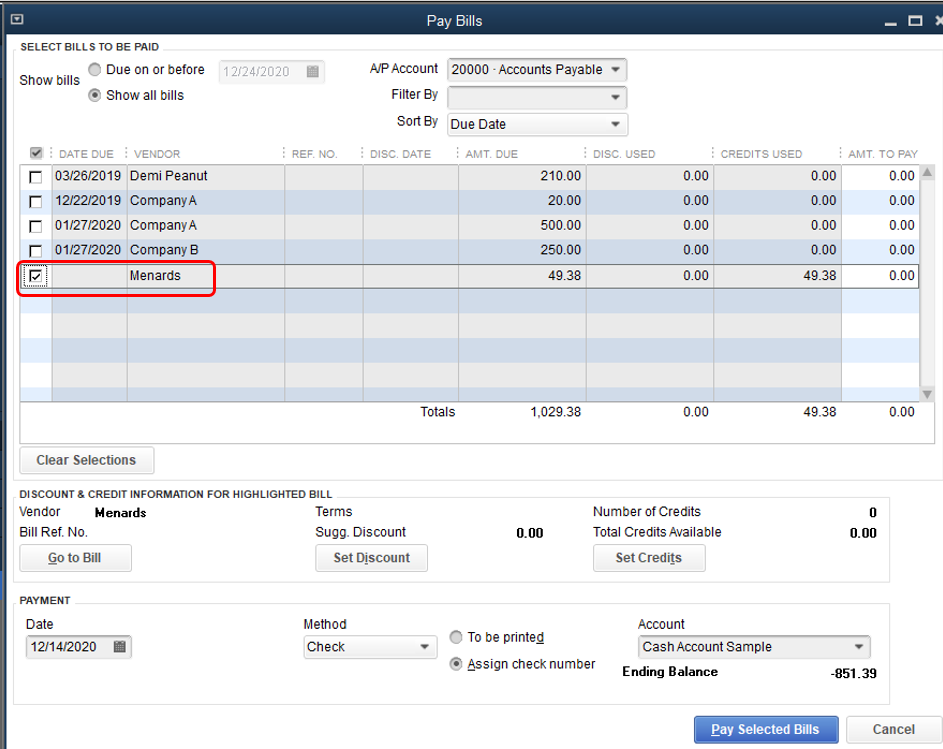

- Click Vendors at the top menu bar and select Pay Bills.

- Check the Credit Card Credit that matches the vendor refund amount.

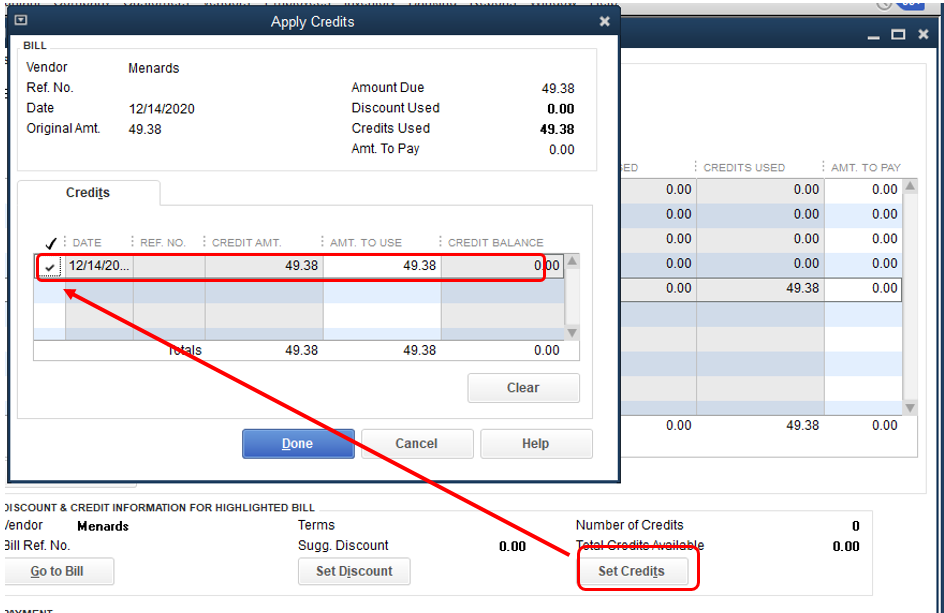

- Tap Set Credits and apply the Bill Credit you created earlier then select Done.

- Select Pay Selected Bills, then select Done.

The following article provides steps on how to manage vendor refunds depending on the situation you have in QuickBooks: Record a vendor refund in QuickBooks Desktop.

If you have additional questions about vendor refunds, let me know in the comment section below. I'll be glad to share some additional insight to help your way around QuickBooks. Have a good day!