Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

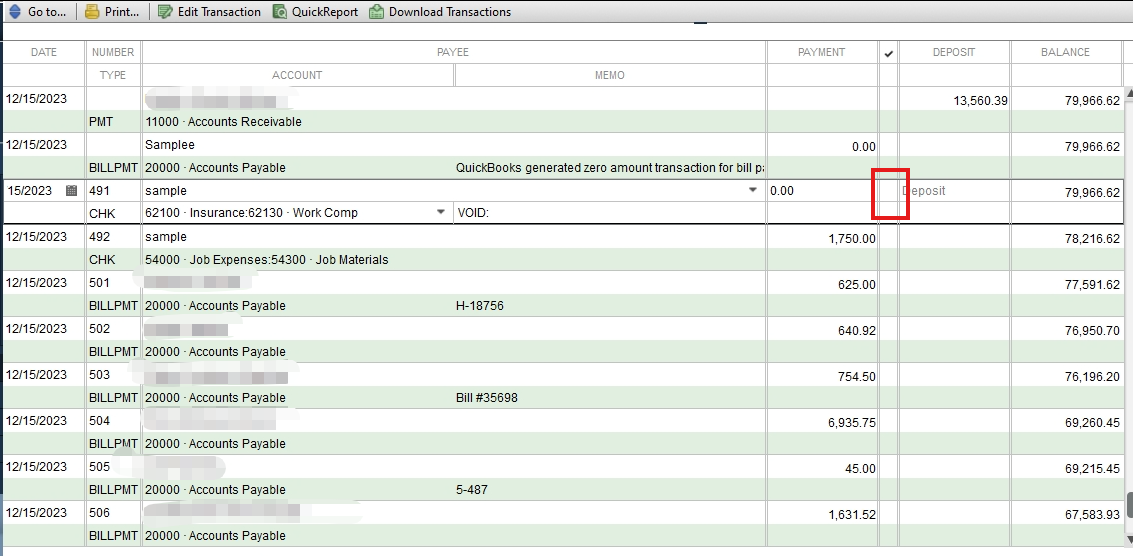

Buy nowWe are using a Quickbooks Desktop version. We voided a check, which seemed to go normally, but when we went to do the reconciliation, I am off by the voided check amount. I went back and looked at the register and it shows the check and it has a $0 amount with a checkmark in the cleared column. What should I do? If I go ahead and reconcile, then my next months balances will be all wrong.

@J-Ro Most likely, somebody had reconciled the transaction you voided. That tends to throw a wrench in QB's brain as far as beginning balances go.

You can either unreconcile back to a point where the balance was still correct, or you can do a mini-reconciliation to get it back to the correct balance.

To ensure accurate reconciliation, uncheck the box in the cleared column for the voided check, J-Ro. Allow me to guide you through the process.

Unchecking the voided check will balance the amount of your account when you reconcile. Here's how:

Once done, you can reconcile your account.

Furthermore, if you experience issues during account reconciliation, you might find this article useful for troubleshooting: Fix issues when you're reconciling in QuickBooks Desktop.

We are dedicated to ensuring that your financial records are accurate. Keep me posted if you have further queries about reconciling. I'm always here to support you.

We did try this and it did not change anything.

I appreciate your efforts in following NicoleAscencionS's answer, @J-Ro. Allow me to help you further so you can successfully reconcile your accounts in QuickBooks Desktop (QBDT).

Before anything else, could you please share the check date? This will help us see if you have reconciled in a previous period, which might explain why the voided check amount still shows up as a deposit.

In the meantime, you can go back to the period when the balance was still correct and unreconciled from today back to that prior month, as recommended by FishingForAnswers.

Follow the steps provided below to get a Previous Reconciliation report to review your past reconciliations.

Here's how:

Also, to find out what to do if your QuickBooks Desktop accounts don't match your bank statements after reconciliation. Check out this article for detailed info: Fix issued when you're reconciling in QuickBooks Desktop.

Regarding the topic we discussed above, we can examine the report for any discrepancies or issues, and customize the report to gather more information and focus on specific details.

If you need further assistance with reconciliation in your QBDT just click the reply button. I'm always here to help.

When you voided the check, you must have selected "Yes" when asked if you wanted QB to create a journal entry (JE) to replace the original check and then a reversing entry (deposit) in the current period. That is what gave you the deposit that you're seeing. The deposit should be dated the same day you voided the check, but there should be another JE to offset that dated the same date as the original check. Do you see that? That's the offsetting entry to balance your reconciliation.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here