Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy accountant does not like me receiving payments unless they are associated with an invoice.

If you are on cash basis, you should use Sales Receipt, not Invoice.

Hello, @davidmatyas. It's great to know that you're in the process of creating a new QuickBooks Desktop file. I'd be delighted to assist you by guiding you through the steps to manage your previous invoices, and ensuring your transactions are accurately recorded in your account.

Since you're using a cash basis, I will agree with Fiat Lux - ASIA on creating a Sales receipt. A cash basis is a bookkeeping method in which you regard income or expenses as occurring at the time you receive a payment or pay a bill.

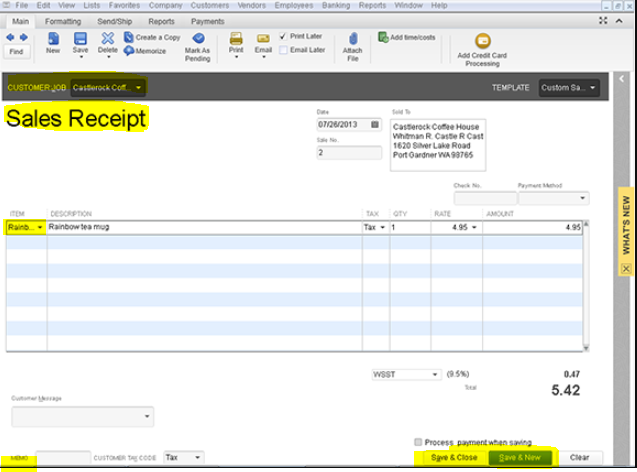

In your case, you can generate a sales receipt in your new company file to record payments received at the time of the sale. Sales receipts can account for payments made by cash, check, or credit card. To create a sales receipt, please follow the steps outlined below:

For detailed information on creating sales receipt, see this article: Create sales receipts.

After sharing the following steps, I would still recommend consulting with your accountant. They can guide you on how to accurately record the invoices to maintain the accuracy of your financial data.

Once you've recorded everything in your new company file, I'll include this article that explains various methods for tracking customer transactions in QuickBooks Desktop: Get started with customer transaction workflows in QuickBooks Desktop.

If you have any other questions about managing previous invoices or any concerns related to QuickBooks Desktop, please don't hesitate to leave a comment. I'm here to assist you. Have a good day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here