Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhenever I add a bill, then create a product with a quantity of 1 it adds the item + an "opening balance equity" entry to the inventory account. It is duplicated. To fix it I either have to adjust quantity and send one of them to the inventory shrinkage account or if I create the product and enter 0 it adds 1 item. We are an equipment dealer so each item is normally pretty unique and used 1 time, we aren't reordering or anything like that. I was just wondering if this seem correct? Its fine to just add a quantity of 0 (we've been doing it for years) just thought I'd ask. I've attached a screenshot that has had the inventory adjusted correctly, normally its showing the value of the item where it says $0.

Hello there, SethFenby.

Thanks for adding a screenshot. I'm here to share some insights about inventory adjustment.

QuickBooks shows the transaction you created and the opening balance equity for the inventory item in the Inventory account. And, yes, we'll have to create inventory adjustments to adjust the quantity of the items since you're using inventory to track them.

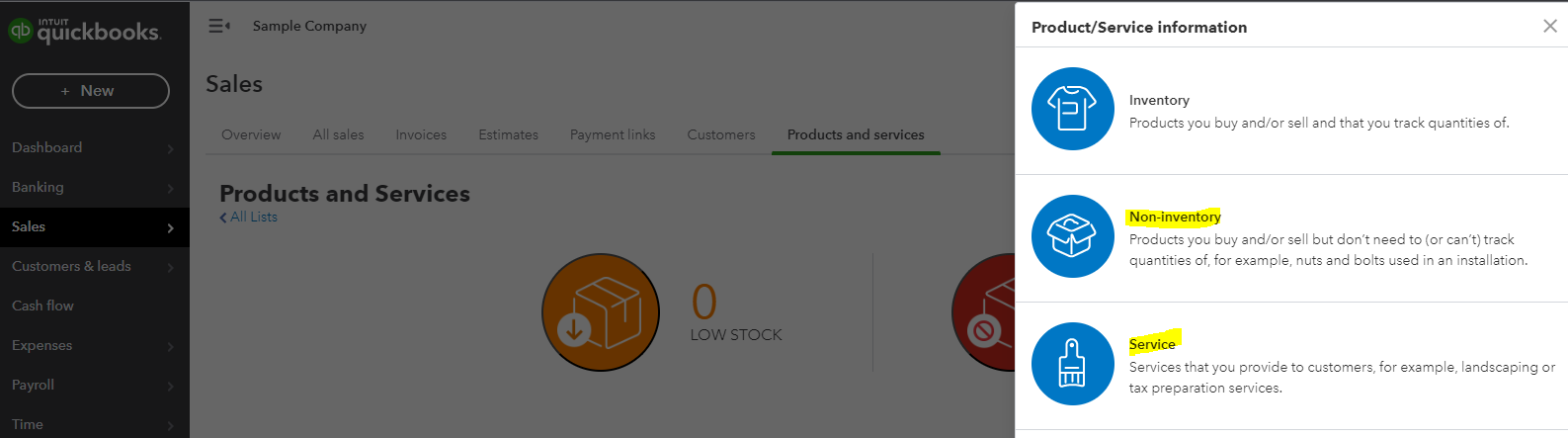

You've mentioned that items are only used once, and you aren't reordering some products. It seems to me that you're not tracking the quantity on hand. If so, we can use record them as non-inventory or service. Please take a look at the sample screenshot below for additional reference:

Still, I'd highly recommend consulting your accountant if you can use other product types for those particular items based on your company setup. They can help and guide you further in this process. This is to ensure everything will remain accurate.

You can use these articles for more details and tips about tracking your inventory in QuickBooks Online:

Please let us know if you need more assistance. I'm right here to help you more. Take care and stay safe.

Thank you for the information! One other question, does the Non-inventory post the items to a cost account? or hold them in an inventory account?

Thanks, Seth.

Seth, thanks for returning to the thread. We're glad to see you back in our Community forum. I'll provide you with further details about the non-inventory in QuickBooks Online.

Non-inventory items don't post to the cost account because it doesn't affect the Cost of Goods Sold. In your situation, you can assign any income account to these items.

Check out this article for more information on inventory tracking and how QuickBooks handles inventory assets, average cost, and Cost of Goods Sold (COGS): Understand inventory assets and cost of goods sold.

Feel free to comment below if you have follow-up questions about non-inventory items or any QuickBooks-related concerns. I'll be around to help. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here