A warm welcome from QuickBooks Community, lisamurry.

I can assure you that having access to invoices, including numbers 284, 285, 286, and 287, is crucial. Losing them from the Invoice tab can be challenging, and I understand how important it is to keep them organized and readily available.

There is an ongoing investigation (INV-90843) regarding the missing invoices. With this, I recommend contacting our Support Team. They can add you to the list of affected users to get updates and fixes once available.

Here’s how:

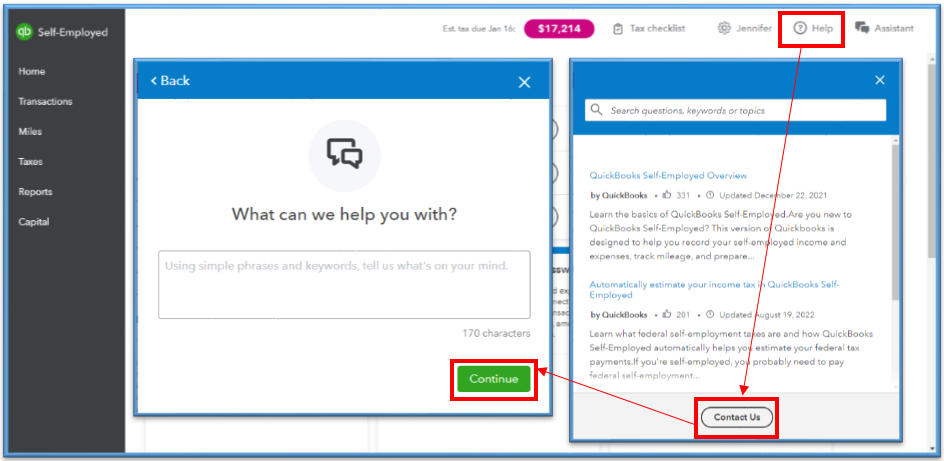

- Go to the Help icon and select Contact Us.

- Enter your concern and click Continue.

Kindly check our support hours to ensure contacting us at a time that suits you best. You can refer to this article to know when our live support is available: Contact QuickBooks Self-Employed Support.

Once everything is good, enter the payment transactions manually in the program. To learn several ways to enter expense receipts, refer to this guide: Record or attach expense receipts in QuickBooks Self-Employed.

If you need to collect sales tax for the products and services you sell, this reference will guide you through the process: Manually track sales tax in QuickBooks Self-Employed.

Your patience is appreciated while we work hard to resolve this matter quickly. I'll be here if you have other concerns about any tasks. Take care.