Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowThanks for posting to the Community, @info-hhceramicco.

It's because the deposits created were not linked with the payments you received from customers' invoices. This will create a double income to your Profit and Loss report.

Received payments have to be deposited into the Undeposited Funds when you haven't deposited the money yet into your bank. So when it's time moving your money into the bank, you can create a bank deposit in QuickBooks and link this payment in real-time. Please see the details created by K_Siman from this article to see the workflow: Using Undeposited Funds in QuickBooks Online.

Here's how to edit the payment:

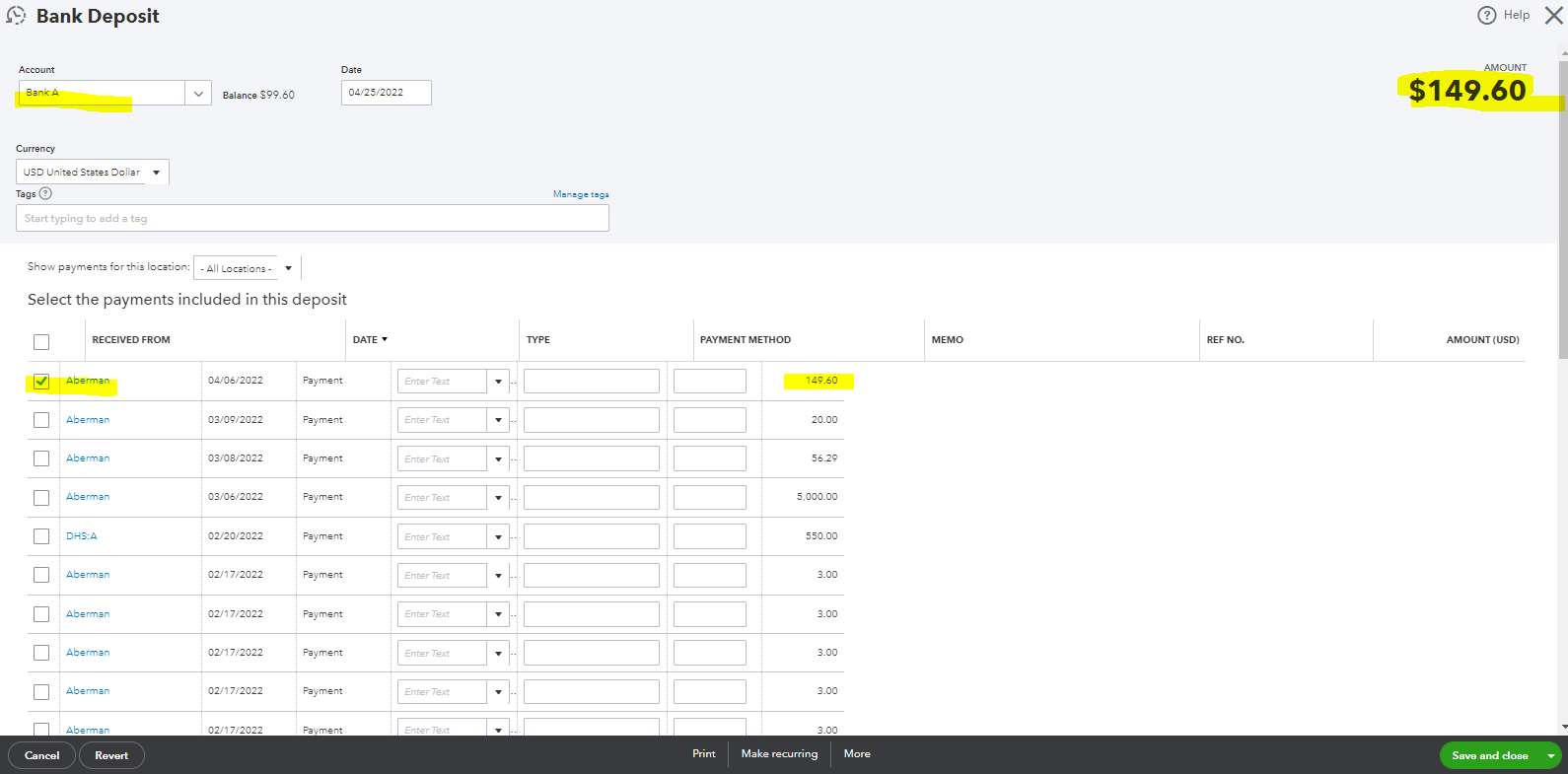

Next, you can run the Deposit Detail report and adjust the period to spot deposits easily. Then edit the deposit to link it to the payment:

However, if both transactions came from QuickBooks Payments account and online banking, I'd suggest deciding what transactions to exclude and what entries to match and record in the bank register.

If you have additional questions about customer payments and bank deposits, feel free to place a comment below. It's my pleasure to help. Stay safe and well.

Very informative thank you. Question - if the invoices are all paid and go into my QuickBooks checking account is it better to just not deposit them on the online portal (referencing your last paragraph)

Very informative thank you. If the payments are coming through QuickBooks invoices and deposited into my QuickBooks checking which are all linked should I just exclude the checking deposits then? Referencing your last para

It's good to see that the information shared helped, @info-hhceramicco.

Yes, you're correct. You'll have to exclude the checking deposits since you have QuickBooks paid invoices and bank deposits linked and deposited into your QuickBooks Checking.

Before that, you have to undo the categorized transaction so it will go back into the For review tab. In this manner, you can exclude the entry.

Alternatively, you can match Checking deposits with the existing transactions created in QuickBooks Online to avoid double income. Take a look at this article for more details: Categorize and match online bank transactions in QuickBooks Online.

When done, you can check this guide in reconciling the account: Reconcile an account. In this manner, you can compare each transaction in your bank statement with the ones entered into QuickBooks.

Feel free to visit again if you have other concerns with recording transactions. I'm always here to back you up. Thank you and have a great day!

This doesn't work in reality for a complex business like mine. Reconciliation is an absolute nightmare.. For example, I will have random weekly sales to 200 plus farmers for a different amount every week with a net 30 and a 3% discount. The farmers will aggregate 4-6 invoices and deduct the 3% if they pay in 30 days of no deduction in 45 days and add 3% if they pay over 60 days. So my checks are not the same dollar value as the invoice and there is no way to know what invoices they are paying to match them up. So I get double revenue or more. In addition, if you get checks that bounce there is no way to take them off, so my income is much much higher in QBO compared to the actuals and it makes tax season a massive pain. Accountants won't even touch it with a ten-foot pole. There needs to be a reference when a payment is made attaching the invoice numbers to it.

Another way it gets messed up is when a customer pays with ACH vis Quickbooks and that correctly books the payment to the invoice then it gets the payment from my bank and books it again.

I understand your feelings, and I appreciate you attempting all available troubleshooting methods to resolve the situation. Allow me to provide extra information to help you sort things out.

Because reconciliation and income reports are independent, reports are not influenced by reconciled accounts. Furthermore, transactions from bank feeds may be reported on the income account, resulting in duplicate transactions once transactions are added. To avoid duplication, match the transactions rather than add them.

Another cause of double revenue is if you received payment and deposited it to Undeposited funds. You added transactions as income when they were downloaded. You can fix it by following the procedures indicated by my colleague.

On the other side, we can use an invoice in QuickBooks Online to record a bounced or Non-Sufficient Funds (NSF) check. There are different ways you can record a bounced check in QuickBooks. However, one of the most straightforward methods is to use an invoice. To record the bounced check and ensure the accuracy of your books, follow these steps: Record a bounced check using an invoice in QuickBooks Online.

Once everything is settled and you're ready to reconcile your account, please see this article for more guidance: Reconcile an account in QuickBooks Online.

Ping me a reply if you need more help in categorizing your transactions or managing invoices in QuickBooks. I'll be around. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here