Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, accounting561.

I'll share some information how taxes in Jobber sync in QuickBooks Online.

Jobber and QuickBooks Online do not share tax names or rates. The invoice will continue to sync with QBO, but it will be taxed at the next applicable rate.

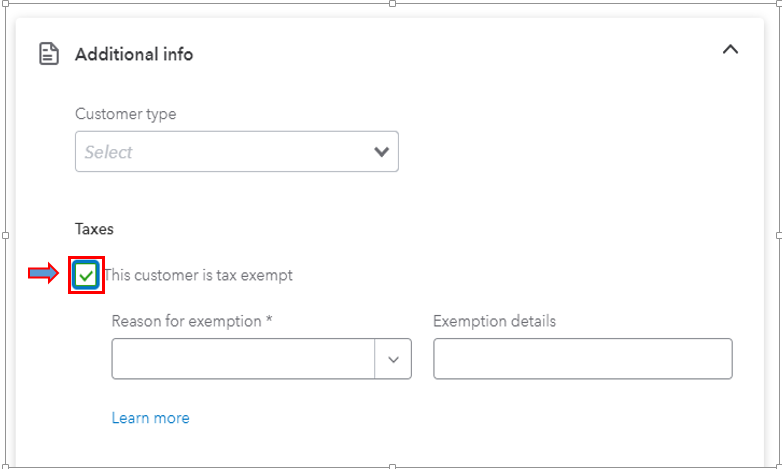

Before syncing your invoices, ensure that your QuickBooks Online customer is set to tax exempt so that they do not incur any taxes. I'll show you how.

You can also read this article to learn more about tracking sales taxes in QuickBooks Online: Switch to automated sales tax in QuickBooks Online.

For future reference, I've included the following resource on recording and receiving payment: Record invoice payments in QuickBooks Online.

You're always welcome to post again if you need further assistance in QuickBooks Online. We're here to help you.

As a user I appreciate the polite response to the question. But as a solution, I feel that QuickBooks could easily just create a jobber name mapping in XML so that when the function to import is called it gets passed the mapping file and the tax rates would be automatically adjusted for tax exempt.

An extra mapping option when importing invoices to QuickBooks seems like a brilliant idea, smallcrete rocks.

I can see how this kind of feature might be useful for your business and other users, particularly for managing the data associated with invoices.

You can also submit a feedback directly to our product development team so they can consider adding this option to QuickBooks.

Here's how:

Once done, our product development team will receive and review your suggestions along with other request.

You can also track your requests in this link: QuickBooks Online Feature Requests.

For more related topics and helpful articles in managing invoices, you can visit our help page: Invoices and payments

Let me know if you need any assistance or have other questions about managing data and invoices. I'll be around if you need me. Have a great day!

Have you found the answer?

I just started the synchronization between Jobber and QB and I am pulling my hair.

I feel the easiest solution is for QB to disengage the AST and allow/receive the invoices as done in jobber and not to change the tax rates.

If you have any suggestions I will like to hear.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here