Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowRetained Earnings shows up on Balance Sheet but I have no idea where it is coming from because my Chart of Accounts Retained Earnings is zero.

Solved! Go to Solution.

QuickBooks creates a Retained Earnings account. It is used to close profit or loss, from the prior years. It has no register. You can go in to the chart of accounts & double click on it. & it will display transactions.

QuickBooks creates a Retained Earnings account. It is used to close profit or loss, from the prior years. It has no register. You can go in to the chart of accounts & double click on it. & it will display transactions.

"because my Chart of Accounts Retained Earnings is zero."

It should show Balance Total = Blank, actually.

The Chart of Accounts shows no Balance for that account; you run Reports to see the data.

"Retained Earnings shows up on Balance Sheet but I have no idea where it is coming"

It is the Net Income from the prior year. The Program "closes" income and expense so that they start at 0 for the first date of the new year.

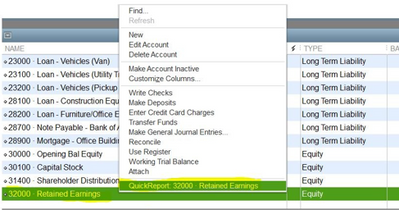

Please see my attached image.

Exactly. I am trying to do my balance sheet and it's showing a number not equal to zero. It says book retained earnings = $13, tax retained earning = $13. My retained earning is zero since it's been paid to shareholders. I have no clue where this arbitrary number came from. My books are balanced and Balance sheet is correct in my books. I imported data from Quickbooks 2019 PRO into 2019 turbo tax Business and all hell breaks loose. Now my balance sheet is outta balance. Back to square one.

Exactly. I am trying to do my balance sheet and it's showing a number not equal to zero. It says book retained earnings = $13, tax retained earning = $13. My retained earning is zero since it's been paid to shareholders. I have no clue where this arbitrary number came from. My books are balanced and Balance sheet is correct in my books. I imported data from Quickbooks 2019 PRO into 2019 turbo tax Business and all hell breaks loose. Now my balance sheet is outta balance. Back to square one.

Hello, @BKG2020.

Let's first run Balance Sheet summary report on an accrual basis. If it still shows out of balance, we can run the verify and rebuild utility tool. This way, we can isolate any data damage to your company file

.

Here's how:

Once completed, you can close and open QuickBooks to ensure that all components are updated. You can refer to this article for more detailed steps: Fix data damage on your QuickBooks Desktop company file.

Also, I've added these articles to help you resolve any unexpected results when generating your reports:

Keep me posted if you have other questions about running your financial reports in QuickBooks. I'm always here to help.

When double clicking in chart of accounts there are no closing entries transactions... my end of year is recorded as the end of the calendar year

Welcome, @chudmaster. I'm here to help you find the information you're looking for.

QuickBooks Desktop doesn't have an actual transaction for closing entries. You'll want to run the Retained Earnings QuickReport to see its adjustments.

Here's how:

You may also set a closing date password. This restricts access to data from the prior accounting period, including the details of every transaction.

Let me know if you have follow-up questions or concerns. I'm here to help whenever you need me. All the best!

Followed your instruction, but quick report shows zero (retained earnings also not showing up on balance sheet (last fiscal year)).

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here