Track home office deductions in QuickBooks Solopreneur

by Intuit•483• Updated 2 months ago

Discover how QuickBooks tracks your expenses and learn about the expense deduction methods it uses.

If you use a space in your home exclusively and regularly for business purposes, you may be able to claim a deduction for your home office expenses. This is one of the most significant deductions that self-employed individuals can take advantage of. To qualify for this deduction, it's important to understand what expenses are eligible, the different deduction methods available, and how QuickBooks Solopreneur can help you keep track of it all.

See if your home office qualifies for a deduction

For the most up-to-date information on home office deductions, consult the IRS website. To qualify for a home office deduction, you only need to meet one of two basic qualifications.

A home office space

Your home office workspace must be reserved for your self-employed work only. You need to use the space regularly (also called "ongoing use") and exclusively for business. That means no one else uses the space for eating or other activities.

Your home office can be an actual room or group of rooms. It can also be an area of a room you use for other activities, such as a dining room or a spare bedroom as long as the office area is clearly separated and obvious to anyone that it's exclusively used for business.

A space for storing business inventory

You can also claim a dedicated space in your home you use to store product samples or inventory for your business. If you use a garage, basement, attic, or spare room, you can claim the square footage the inventory takes up. If it's in an area outside your home office space, like a closet on the other side of the house, you can include that too.

Keep in mind that you can only count the space the inventory physically occupies (like a 4" x 3" corner, for example), not the entire garage or closet.

Learn about home office deduction methods

The IRS has two home office deduction methods: the simplified and actual expenses method. Both are based on square footage. Here are the latest square footage rates from the IRS. Be prepared to measure your space.

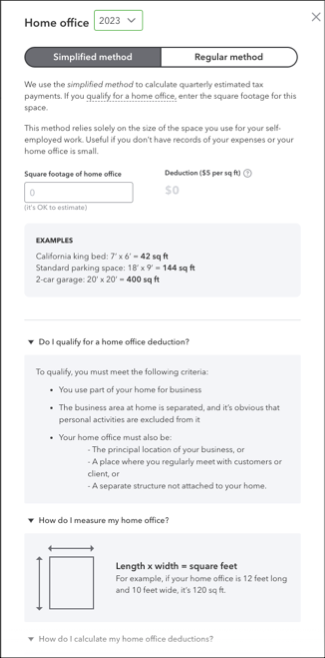

Simplified method

For the simplified method, all you need to do is measure the square footage of your home office space or the area you store inventory.

Determine the square footage (length x width) and choose the closest home office size:

- 100 sq ft, or about the size of a small bedroom

- 200 sq ft, or about the size of a large bedroom

- 300 sq ft or more, or about the size of an average living room

The deduction is a flat rate (currently $5 per square foot) to a maximum of 300 square feet. This flat rate takes your other home office expenses like rent and utilities into account. So if your space is about 100 square feet, your deduction would be $500.

The simplified method is what we use to calculate your quarterly estimated tax payments. If you're entitled to this deduction, make sure you select a home office size in the Home Office section of the Income Taxes page. If you don't, the deduction won't be included in your estimates.

Actual/Regular expenses method

With this method, your home office space is a percentage of your home's total square footage. The percentage determines how much of your total home expenses (like rent, utilities, insurance) can be deducted for your home office. Here's an example:

- Your home office space is 132 square feet (11" x 12")

- Your total home square footage is 1,100 square feet

- Your home office represents 12% of your entire home space

- 12% of your rent, utilities, insurance, and so on will count toward the deduction

Categorize home office expenses

We learned that to file home office deductions, you have two options - simplified or regular method. It's important to keep a record of every home office expense in QuickBooks Solopreneur. This helps you to estimate your deductions accurately when you are ready to file your taxes. QuickBooks provides you with estimates for both methods based on your specific expenses and your square footage. This helps you to choose the best method to maximize your deductions and file your taxes smoothly.

More like this