Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI submitted 940& 041 on January 2,2025 IT ONLY SAYS SUBMITTED TO INTUIT. It doesn't say submitted to agency or accepted we are now January 11,2025 I'm a little worried because it doesn't let me submit again

We appreciate your use of QuickBooks Desktop payroll for managing your 940 and 941 forms, Tkianna111. You can monitor the status of your 940 and 941 payments, providing you with assurance about your filings. Let me walk you through how to do it within QuickBooks Desktop Payroll.

In QuickBooks Desktop Payroll Enhanced, you have the convenience of electronically paying and filing your 941/944 and 940 tax forms. This method is the quickest and simplest way to ensure compliance with IRS regulations.

Once you've filed your forms, you’ll get an email confirmation within 24-48 hours. Or, check their statuses within QBDT payroll.

Here's how to verify payment statuses:

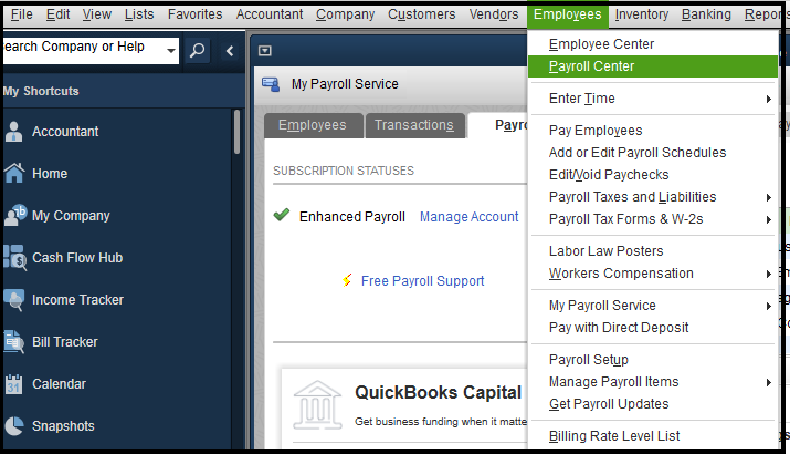

1. Choose Employees, then Payroll Center.

2. From the Payroll Center, pick the File Forms tab.

3. Select the E-Filings tab, in the Filing History section,

4. If the status isn't updating, toggle between the Saved Filings tab and the E-filings tab.

5. Choose the View link in the Audit Trail column for more details.

For your reference, please refer to the status provided below:

Moreover, I encourage you to check your email for any confirmation from Intuit or your state agencies. If you have not received anything, please reach out to our QuickBooks Desktop Payroll support team for additional guidance. They can also verify if there are investigations regarding this matter.

I'm adding this page for more guidance about electronic fillings and payment for your forms and taxes: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

In addition, I have provided this article to offer more comprehensive details regarding the use of payroll reports in QBDT. Run payroll reports.

Thank you for trusting QuickBooks Desktop Payroll to manage and e-file your Form 940 and Form 941. We appreciate your choice to streamline your payroll needs with us, ensuring accuracy and compliance. Should you have any questions or need further assistance, leave a comment below.

I'm having the same problem. Filed January 2 2025, still have not received confirmation from QBs that the Feds have processed tax form.

Hi, Kvincelli.

It's great to her that you're staying on top of your tax submissions. Let me help you ensure that everything is on track.

After you've filed your forms, an email confirmation should arrive from Intuit within 24-48 hours after filing your forms. Sometimes, these emails can get filtered into spam or other folders by mistake. Here’s how to locate it:

If you haven’t seen it yet, don’t worry, you can also check the submission status directly in QuickBooks Desktop (QBDT) Payroll.

If you’ve followed these steps and are still having issues, it's a good idea to contact the QuickBooks Desktop Payroll Support team for further assistance. Here's how you can reach them:

Additionally, here's a helpful article for you that thoroughly explains how to use payroll reports in QuickBooks Desktop. Check it out: Run payroll reports. It’s full of information to guide you through.

If anything else pops up or you have other concerns, please feel welcome to add them in the thread The community is filled with people who have been in your shoes and are ready to provide the insights and answers you seek, no matter the time or day. We're here to help anytime you need us.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here