Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Recently a remote employee moved to another state. I am unable to change form 940 from single state to multi state employer. I did download entire payroll update. What else do I need to do to change the form and have schedule A come up?

Hi there, @ChrisM67.

Allow me to share some insights on how to change form 940 from single to multi-state employer in QuickBooks Desktop.

While the option to assign multiple states under an employee profile is still unavailable, the transition must be done manually. This means that you need to switch the states manually the moment you create payroll for the employees' working hours.

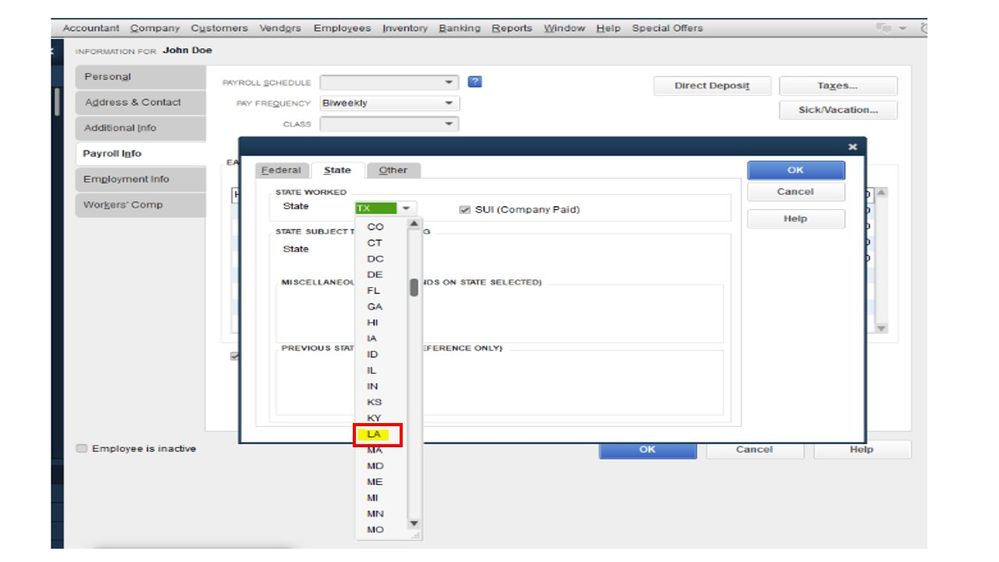

I can assist you with a step-by-step process to simplify your task of keeping track of everything. For instance, if you need to process a pay run for Los Angeles but the default state is set to Texas, I can guide you on how to change the state.

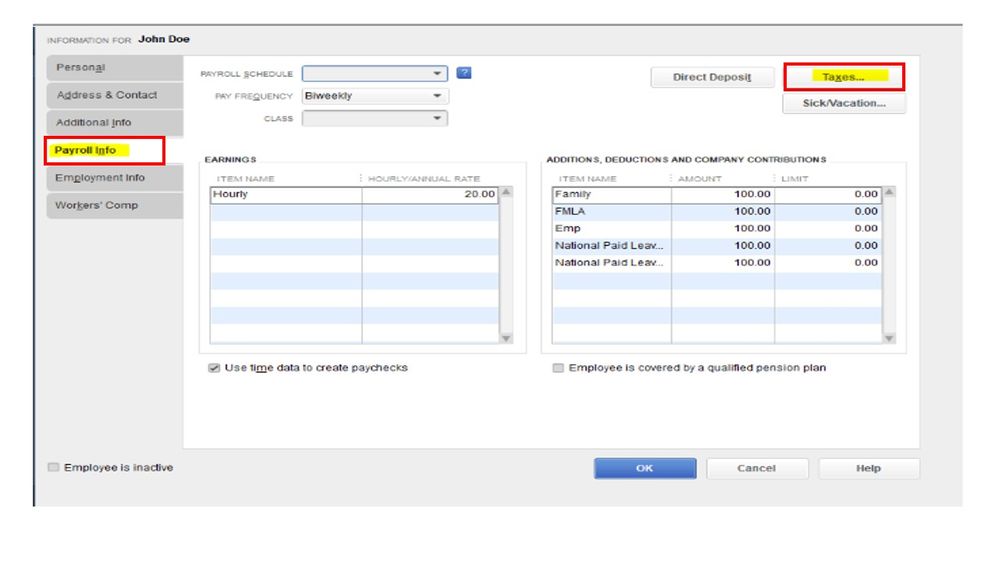

Firstly, you need to create two different State Unemployment Insurance records.

When you process payroll, the system will use the state assigned to calculate taxes. Here are some examples:

Payroll processed for Texas:

Payroll processed for Louisiana:

With this process, taxes will not be mixed up and are reported accordingly. Here is a sample report to show you how QuickBooks will treat multi-state payroll:

Thank you for replying so quickly. The state side of the unemployment works. I have filed and paid those taxes already. It is form 940 that I am having issues with. I assumed that since the state forms compute and print out correctly, the federal one would as well.

Will I need to print the form, white out the single state (FL), hand fill out the schedule A, and mail the form? Is there a way to make QB correctly fill this form out so I can electronically file this form?

Thanks for getting in touch with the Community, ChrisM67.

As of the moment, filing 940 within QuickBooks is not yet available I suggest checking with the IRS or download the blank copy of the 940 and fill out manually outside QuickBooks; employers in the United States are required to pay Federal Unemployment benefits for their employees.

Employers are required to report their annual Federal Unemployment Tax Act (FUTA) tax using Form 940. The FUTA tax, along with state unemployment tax systems, provides funds for the payment of unemployment compensation to workers who have lost their jobs. It's important to note that only employers must pay FUTA tax, not employees. Therefore, do not collect or deduct FUTA tax from your employee's wages.

Access the IRS website; visit the official IRS website at www.irs.gov. Hover over the Forms & Instructions tab on the IRS website and select "Form 940" from the list of forms.

Additionally, you may want to consult with a tax professional or accountant if you have specific questions or are unsure about any aspect of filing Form 940.

In addition, I have gathered some articles that you may find helpful in setting up e-file and e-pay. You can also refer to these resources to learn how to set up QuickBooks Desktop Payroll, which will enable you to pay your state payroll taxes electronically and file state forms without any hassle.

Let me know if you have further questions or clarification regarding your 940 Form in QuickBooks Desktop. The Community is here to help 24/7.

I do not see the last emailed response, so I am replying here. If I am understanding correctly, there is no way to have QuickBooks create a form 940 with more than one state for Part 1, 1b, including the schedule A. I will do it by hand and figure out how to submit that electronically. Thank you

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here