Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI appreciate for following the steps stated in the article to disable the sales tax feature in your QuickBooks Online (QBO) Sandbox company, albelkin. I'm going to share some specific information about how to carry out this task effectively.

To answer your questions, the Automated Sales Tax (AST) interface in QuickBooks Online (QBO) hasn't changed as of posting, and as with normal QBO accounts, sandbox companies follow the same steps with enabling or disabling sales tax option.

I acknowledge you've ensured deleting the data to start fresh in your sandbox company. I'd still encourage ensuring once more there are no transactions created after Automated Sales Tax (AST) was enabled. You can pull up a Sales Tax Liability Report to help in this task. Follow these steps:

Once done, you can go back to the Sales tax, then Sales tax settings

to disable sales tax.

Alternatively, consider creating a new sandbox company. This ensures that you can continue performing an invoice import with no AST enabled. You can follow these steps:

Since you've been trying to import invoices from your company as a test, you can check out this article on how to import invoices in QBO: Import multiple invoices at once in QuickBooks Online.

With the information I've shared, you should be able to disable Sales Tax and successfully import invoices in QBO. If have further questions about this process, please let us know. We're ready to offer prompt assistance to address your concerns.

I appreciate your help but none of this worked:

To repeat all I’m trying to do is test the Invoice Import so I can prepare it for my client. At this point, I’ve put in many hours that I won’t be able to bill to the client. I don’t know if they can give me access to their live data (or preferably a copy), otherwise my choices are to work on-site (2 hrs away) or to just tell them I can’t do the project.

Your efforts in going through the suggested resolutions are highly appreciated, Albelkin. Let me route you to the appropriate support team to turn off sales tax in your QuickBooks Online (QBO) Sandbox company.

First off, once you set up a customer in California within QB, the system will automatically create a sales tax agency for the state. If there are no transactions linked to this specific customer, it will display zero sales and zero tax owed. Additionally, if the sales tax agency is marked as inactive, it may have been inadvertently marked as such.

For more information about sales tax management in QBO, check out this article: Sales tax in QuickBooks Online.

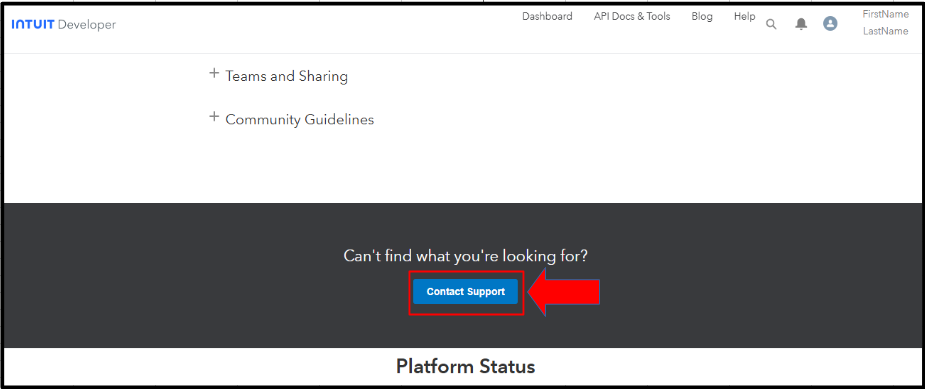

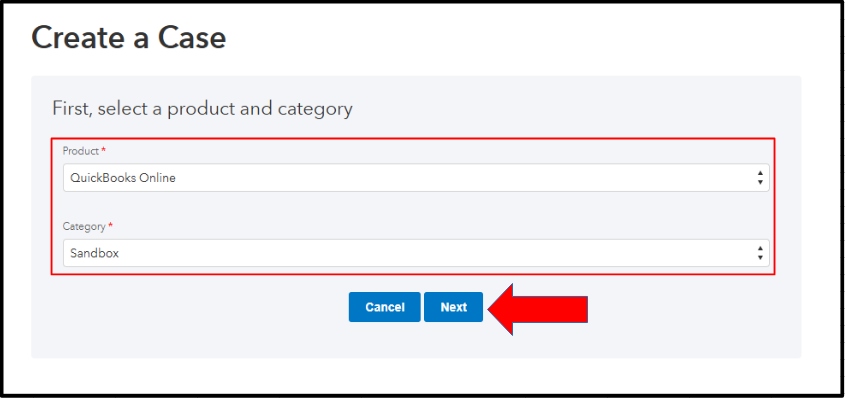

Moreover, since you've created a new Sandbox company and encountered issues that prevented you from disabling the sales tax feature, I recommend contacting the Intuit Developer Support Team. This way, they can provide tailored resolutions to resolve your concerns. Here's how to reach them:

Finally, I will provide this resource to help you generate a Sales by Customer Detail report and other sales reports in QBO, enabling you to view valuable information about your customers' purchasing behaviors: Run a report in QuickBooks Online.

If you have other questions about managing sales tax in QBO, please don't hesitate to leave a comment below. We're always here to assist.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here