Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am trying to record state sales tax payment. I am unable to enter tax adjustment for use tax as it is classified at COGS not an expense.

Hello there, Christa8.

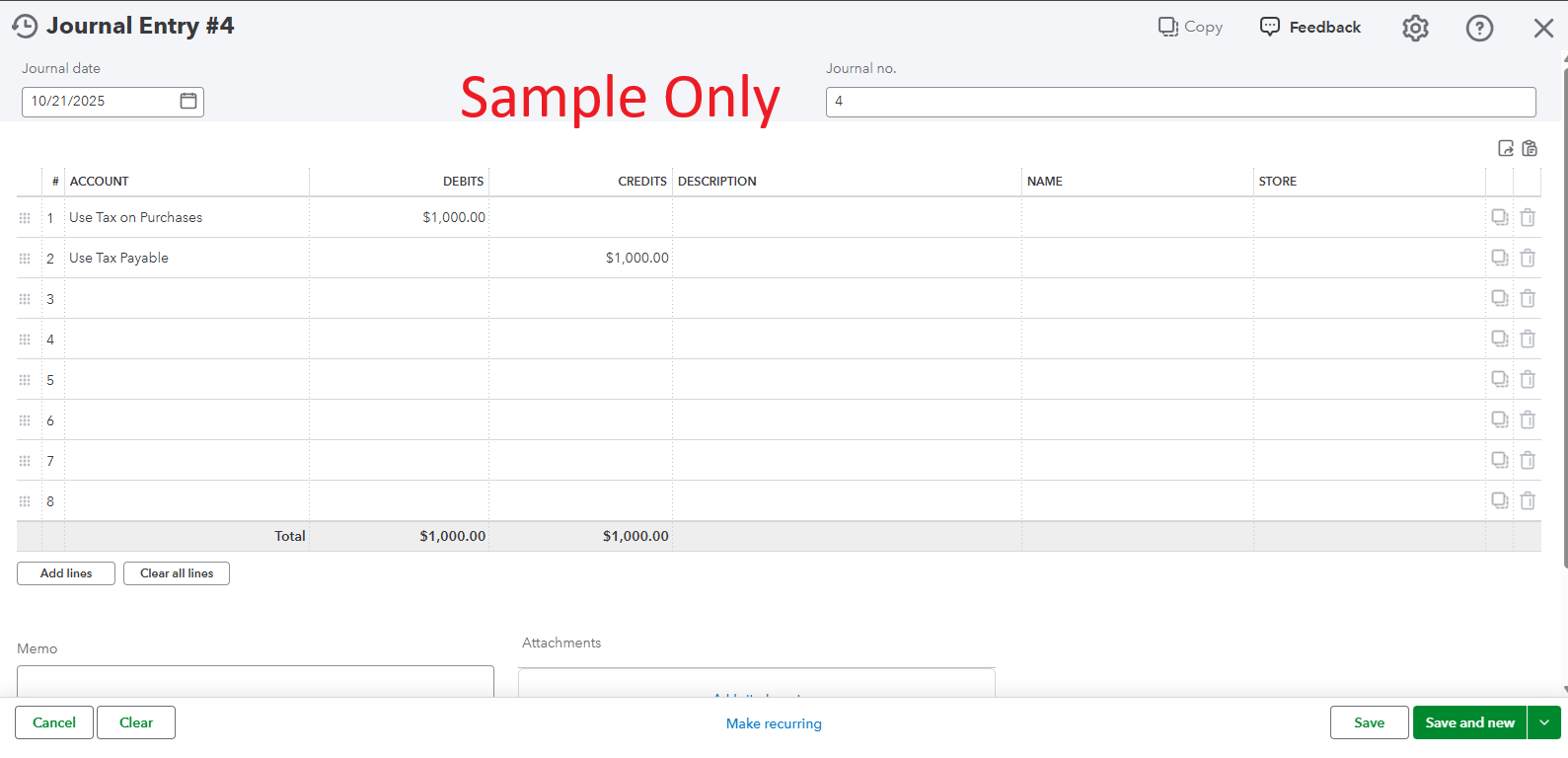

QuickBooks Online (QBO) automatically categorizes sales tax adjustments as expenses and does not allow direct classification as Cost of Goods Sold (COGS). However, as workaround, you can create a journal entry or adjusting transactions to record use tax adjustments under COGS.

Here's how to enter the use tax adjustment as COGS when recording a sales tax payment.

Since a use tax adjustment can affect your financial reports, I recommend consulting an accountant to ensure it is handled correctly and complies with accounting standards.

Additionally, need help managing your books? Our QuickBooks Live Expert Assisted team has your back. We have dedicated bookkeepers who assist you with streamlining your accounting processes.

Please don't hesitate to let us know if you have any further questions or need additional assistance. We're here to help.

Hi, @christa8.

Hope you're doing a great day. I just wanted to follow up on your concern and check if the information provided helped you clarify your concern. Please let us know if everything is now working as expected or if you have any clarifications.

We’d be glad to provide further help. Looking forward to hearing from you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here