I value your desire with managing foreign taxes, @INFO2142. I'll explain how QuickBooks handles this.

QuickBooks is designed to manage payroll taxes only within the same region as your account and does not support foreign taxes. You can manually create a specific tax account and record the transactions using a Journal Entry to record foreign taxes. For precise compliance with international tax regulations and guidance on setting up a tax account, it is advisable to consult your accountant.

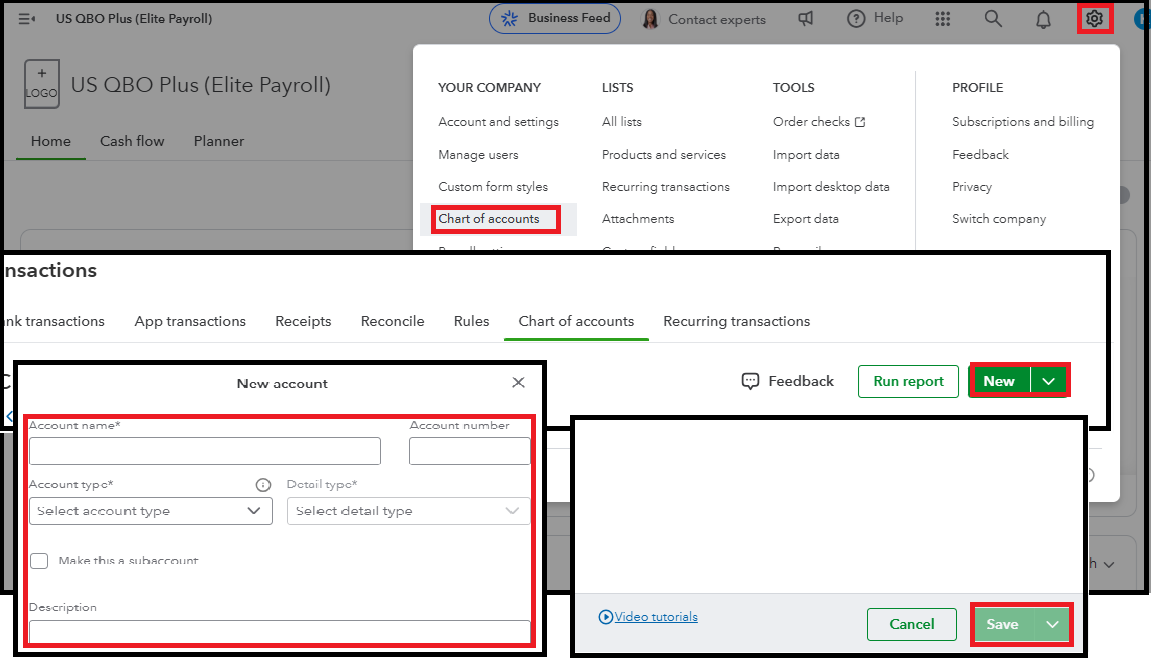

Here's how to set up the tax accounts:

- Go to Settings and select Chart of Accounts.

- Click New.

- Enter the Account Name.

- Choose an Account Type and select Detail Type from the dropdown.

- If applicable, check Make this a subaccount and select the Parent Account.

- For Bank, Asset, Credit Card, Liabilities, or Equity accounts, enter the Opening Balance and the starting date in the As of field.

- Add a Description for extra details about the account.

- Click Save.

If you need help managing and filing taxes in a US state soon, refer to this resource: Set up QuickBooks Online Payroll to pay and file your payroll taxes and forms.

I'll be keeping an eye on this thread, @INFO2142. Feel free to post any questions or concerns about payroll taxes or QBO concerns. My team and I are here to assist you whenever you need help.