Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowA bi-weekly payment did not go through on time and was resubmitted 2 weeks later . I have received a penalty and would like to see if it can be paid through QB electronically and how.

Make your Pay Liability check and click on the Expenses tab. Enter a Penalty here. Hit Recalc. This is the Total Payment to send.

Hello there, @MMurdy.

Allow me to share some information about paying penalties in QuickBooks Desktop (QBDT).

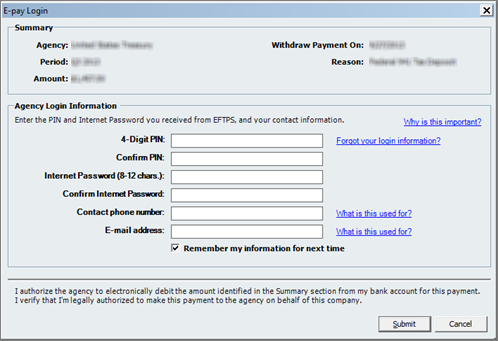

Yes, you can file the penalty electronically. When you have existing liabilities under the Pay Liabilities tab, you can add the penalty amount under the Expenses column.

Here's how:

You may check this article for additional reference: Set up and pay scheduled or custom (unscheduled) liabilities. We also have an option to pay penalties on the EFTPS website.

Stay in touch if you have any other concerns about paying penalties in QBDT. Have a wonderful day!

I am still confused on how to record a payroll penalty in QB

Thanks for getting in touch with us today, @67,

I want to make sure you can pay your penalty together with your e-payments.

My peer @Angelyn_T provided the correct steps to add the penalty and interest on your liability checks. Let me show you how it is done:

Here's a great article to know more about electronically paying payroll tax liabilities: E-Pay tax liability payments

That should get you on the right track, @67.

Don’t hesitate to comment below if you have any additional questions about the process. I'll be glad to help you whenever you need a helping hand. Have a nice day!

The process outlined above, also includes payment of a scheduled payment. In the example that is around $3,061.32. All I want to pay is the penalty and not the scheduled payment.

Hello JFEngineering,

You can e-pay the penalty alone directly to the state agency or IRS website. Let me help you get around this.

Once you're done, please check your register to see the check.

You might also find this article helpful in the future: Correct liability payments made in Write Checks instead of Pay Liabilities.

I'll around if you have additional questions. Feel free to swing by anytime.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here