Hi, @KSold. I'd be glad to assist you with this.

Changes in sales tax law in a state can affect how we can charge and pay for sales tax owed. We can create a sales tax liability adjustment in QuickBooks Desktop (QBDT) to correct sales in a previous tax period without associating it with specific sales. I'd like to discuss this in detail and guide you through the process to accomplish this.

When creating sales tax adjustments, we're moving money into or out of the Sales Tax Liability account. You can follow these steps to adjust your sales tax due because of the change in sales tax law. Here's how:

- Go to the Vendors menu. Then, select Sales Tax.

- Choose Adjust Sales Tax Due.

- Enter the Adjustment Date and Sales Tax Vendor

- Choose an Expense account for the Adjustment Account because we're adding the back owed sales tax to the Sales Tax Liability account.

- Select the Increase Sales Tax by radio button. Then, enter the Amount.

- Review other details. Then, hit OK.

After this, we'll have to adjust specific sales tax items if there are multiple types of sales tax payable to the same vendor, to ensure the allocated amount matches the reporting accurately.

- Go to the Customers menu and select Enter Sales Receipts.

- Leave the Customer field blank.

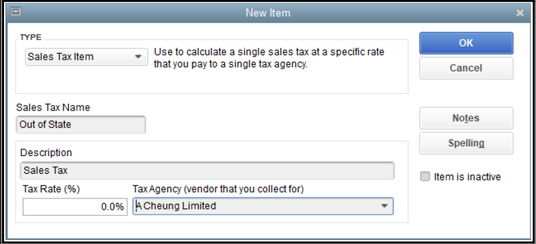

- Select the Tax drop-down and choose a 0% sales tax item. If none exists, select Add New and create one, as in the image below.

- In the Item column, select the first empty line and choose the sales tax item you want to adjust.

- In the Amount column, enter the amount of the adjustment. Then, press Tab or Enter.

- Select OK when you receive the message "Changing the amount of a tax line item may cause your sales tax reports to be incorrect."

- Repeat steps 4 to 6 for any other sales items to be adjusted.

- Select Save & Close when done.

If you need to review sales tax reports after this, let me add this article as a guide: Review sales tax reports.

Keep us posted if you need further assistance charging and paying for back owed sales in QBDT due to a change in sales tax. We'll do our best to assist. Take care.